By DAVID ESPO, AP Special Correspondent

WASHINGTON - Republican congressional leaders stressed a willingness Wednesday to extend a Social Security payroll tax cut due to expire Dec. 31, setting up a year-end clash with Democrats over how to pay for a provision at the heart of President Barack Obama's jobs program.

"We just think we shouldn't be punishing job creators to pay for it," said Senate Republican leader Mitch McConnell, scorning a Democratic proposal to raise taxes on million-dollar income earners.

Instead, Senate Republicans called for a gradual reduction in the size of the federal bureaucracy, as well as steps to make sure that million-dollar earners don't benefit from unemployment benefits or food stamps. They also recommended raising Medicare premiums for individuals with incomes over $750,000 a year.

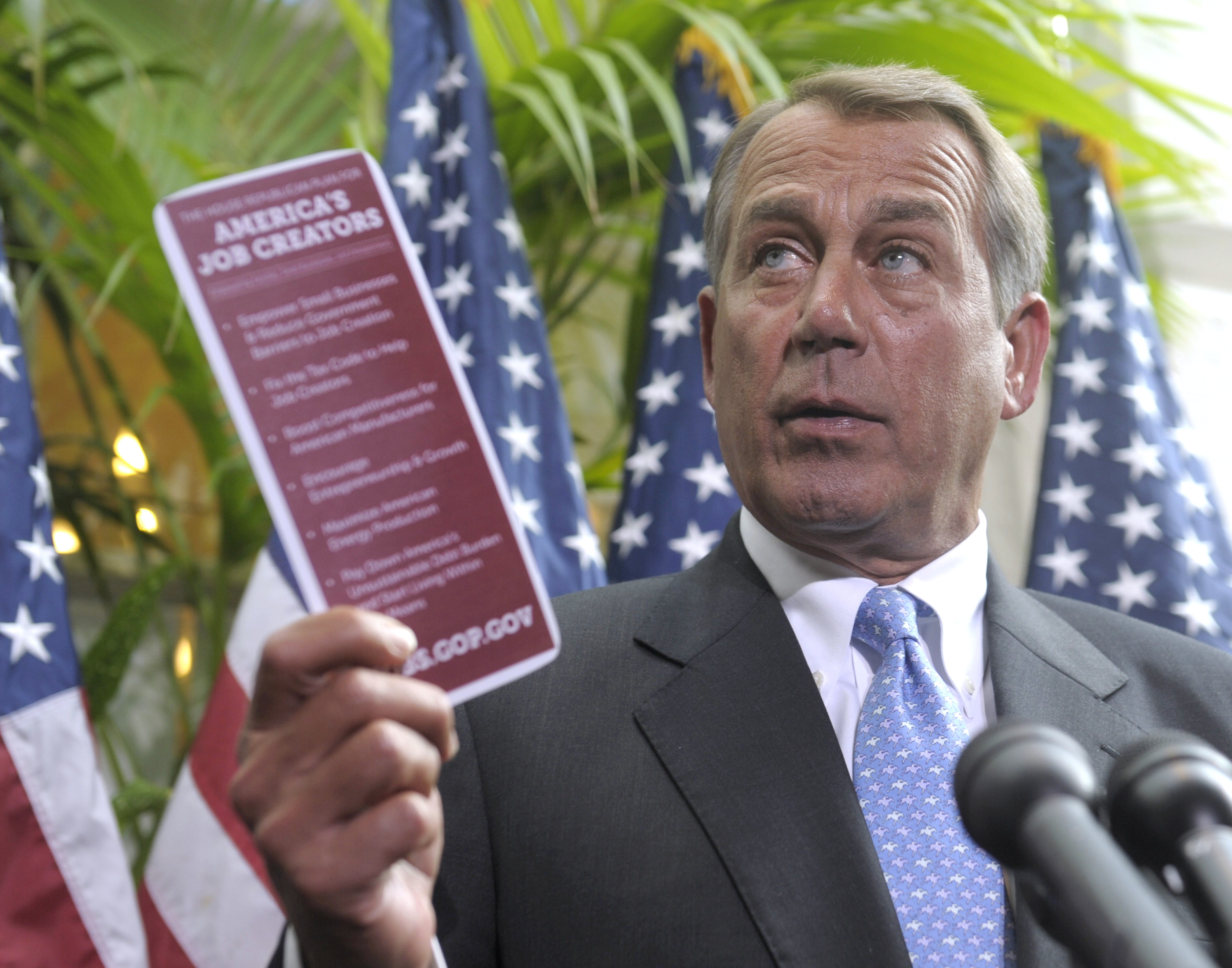

House Speaker John Boehner said flatly that any tax cut extension will be offset by cuts elsewhere in the budget to avoid raising federal deficits. Numerous Republican officials noted that Obama had said the same thing was true of the plan he unveiled in a nationally televised speech to Congress in September.

The events in Congress, coupled with Obama's fresh appeal for renewal of the payroll tax cut while speaking Wednesday in Scranton, Pa., indicated that leaders in both parties want to seek a compromise less than a week after Congress' high-profile supercommittee failed to find common ground on a related economic issue, a plan to reduce deficits.

Yet nearly a full year before the 2012 elections, it also appeared that lawmakers in both parties are eager to compete for the political high ground before any compromise can be struck on the payroll tax or an extension of unemployment benefits that Republicans also said they might approve.

In a visit to blue-collar northeastern Pennsylvania, Obama warned of a "massive blow to the economy" if Republicans oppose his call for a renewal of the payroll tax cut approved a year ago as a way to stimulate economic growth.

"Are you going to cut taxes for the middle class and those who are trying to get into the middle class, or are you going to protect massive tax breaks for millionaires and billionaires?" he said, referring to Republicans.

"Are you going to ask a few hundred thousand people who have done very, very well to do their fair share or are you going to raise taxes for hundreds of millions of people across the country?"

Speaking later in New York City, Obama later sounded more conciliatory toward Republicans such as Boehner and Senate Minority Leader Mitch McConnell of Kentucky.

"For the last couple of days Mr. Boehner and Mr. McConnell have both indicated that it probably does make sense not to have taxes go up for middle class families, particularly since they've all taken an oath not to raise taxes," Obama said. "And so it's possible we'll see some additional progress in the next couple of weeks that can continue to help strengthen the economy."

Senate Democrats have set a vote for later in the week to pay for the tax cut renewal by imposing a permanent 3.25 percent surtax on individuals or couples earning more than $1 million a year, a political maneuver designed to cast Republicans as the protectors of the wealthy at a time when unemployment is at 9 percent nationally.

The proposal has no chance of gaining the 60-vote Senate majority needed for approval.

The Senate Republican alternative, unveiled in late afternoon, envisions extending an existing pay freeze for government workers through 2015 - a provision that would apply to lawmakers. It also proposed gradually cutting the government workforce by 10 percent, or 200,000 positions.

Additionally, Republicans recommended taxing away the value of unemployment benefits and denying food stamps to any household with an income of $1 million or more, as well as raising the Medicare premium paid by individuals who earn more than $750,000 a year.

Republicans said their proposal would raise about $221 billion over a decade, covering the cost of a one-year extension of the existing payroll tax cut and leaving $111.5 billion left over for deficit reduction.

"The Democrats can say they just want some people to pay a little bit more to cover this or that dubious proposal," said McConnell, who also noted that there were misgivings inside his party over Obama's proposed tax cut extension.

"Think about that. The Democrats' response to the jobs crisis we're in right now is to raise taxes on those who create jobs. This isn't just counterproductive. It's absurd."

Adam Jentleson, a spokesman for Senate Majority Leader Harry Reid, said the GOP plan as written won't pass. "Now that Republicans have reversed their position on this middle-class tax cut, we look forward to working with them to negotiate a consensus solution," he added.

The extension of unemployment benefits is also included in the jobs program Obama announced in the fall, at a cost of $48.5 billion over a decade.

The overall cost of Obama's plan was $447 billion over 10 years, and his recommendations concerning the payroll tax account for well half the amount.

Under bipartisan legislation Obama signed late last year, the 6.2 percent payroll tax paid by workers on incomes up to $106,800 was cut to 4.2 percent through the end of 2011. The president has proposed reducing that further, to 3.1 percent, for 2012.

In addition, he is asking lawmakers to grant a similar tax break to businesses by halving the 6.2 percent they pay on workers' wages, up to $5 million in payroll.

Those two changes carry a cost of $247.5 billion, according to the White House.

The millionaires' surtax was a late change in the president's proposal, insisted upon by Senate Democrats who balked at some of Obama's initial proposals.

Initially, Obama proposed higher taxes on family incomes over $250,000 and on the oil and gas industry.

The first request troubled Democratic senators from states like New York, New Jersey and California, where large numbers of families would be hit by the increase. The second drew opposition most prominently from Louisiana Sen. Mary Landrieu, whose state is home to numerous oil and gas operations.

The president also proposed higher taxes on hedge fund managers and corporate jet owners.

Those increases also disappeared, although supercommittee Republicans said they would be willing to accept the corporate jet increase as part of a deal that made big cuts in federal spending.

---

Associated Press writers Alan Fram and Andrew Taylor contributed to this report.