Hamilton County and Chattanooga officials are facing more than $1 million each in lost property tax revenue after three downtown buildings were sold within the last six months for less than their appraised value.

Combined with the possible end to the county and city sales tax agreement, the county could be putting together next year's budget with $11 million less revenue.

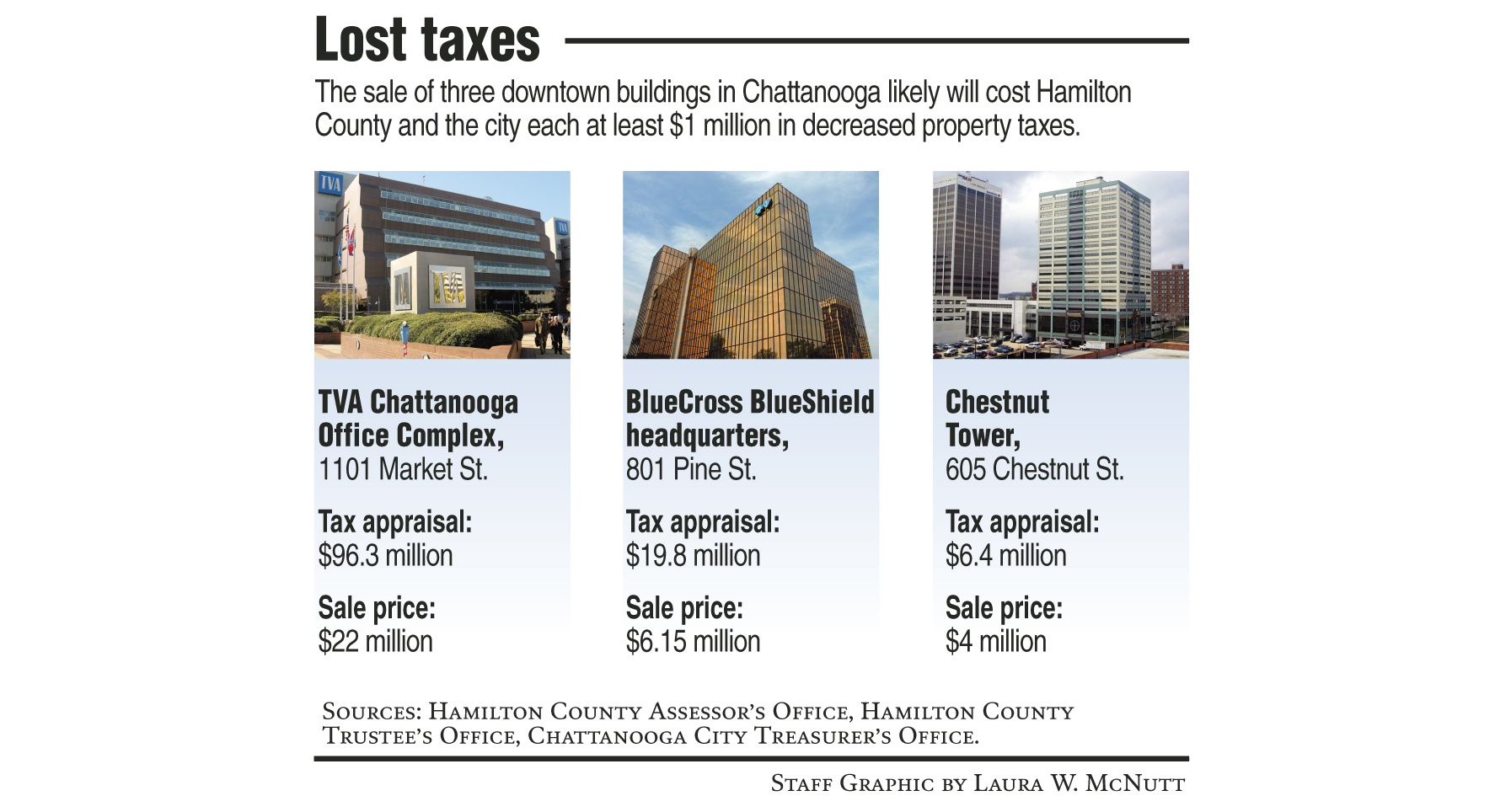

The Tennessee Valley Authority repurchased its Chattanooga office complex for $22 million, which means the building is now exempt from taxes. When it was owned by a Chicago-based private company, the building generated about $1 million each in property taxes for Hamilton County and the city of Chattanooga.

The sale of the former BlueCross BlueShield of Tennessee headquarters on Pine Street and the Chestnut Tower at Sixth and Chestnut streets for less than their appraised value also could reduce tax collections, Hamilton County Assessor Bill Bennett said.

Chattanooga officials said the city collected $175,561 in property taxes from the Gold Building and $59,385 from the Chestnut Tower.

Developers Ken and Byron DeFoor bought the BlueCross BlueShield building in December for $6.15 million -- less than a third of its $19.8 million appraised value -- and Republic Parking System President Jim Berry bought Chestnut Tower for $4 million -- 38 percent below the $6.4 million appraised value by the county.

Bennett said the assessment of the two buildings isn't settled.

County Commissioner Tim Boyd raised the issue Tuesday night during Hamilton County Mayor Jim Coppinger's "County Conversations" forum at East Ridge Middle School.

"It takes 1,500 homes to make up $2 million in property tax that we lost on three commercial real estate transactions," Boyd told the audience.

As mayor, Coppinger will prepare the upcoming budget.

"Anytime there's a revenue decrease or you lose a source of revenue then obviously it creates additional challenges and we'll just have to address them," Coppinger said.

Coppinger is also facing the possibility that the sales tax agreement with the county will expire and cost the county $10 million. The sales tax agreement regulates distribution of sales taxes collected throughout the county to a variety of social service and other agencies.

Coppinger has repeatedly emphasized he wants to create a budget that does not increase taxes. The county's current budget is $638 million.

Richard Beeland, spokesman for Chattanooga Mayor Ron Littlefield, said the city would have to wait and see how the building sales would impact the city's budget.

"The overall base probably will not be materially affected," he said.

As a government-owned utility, TVA does not pay property taxes to local governments. It makes payments in lieu of taxes based upon sales and facilities in each area.

TVA spokesman Scott Brooks said TVA is still considering what, if any, additional payments it could make to the city and county based upon its purchase of its downtown office complex.

"As the property was purchased in January, TVA is still reviewing the situation," Brooks said. "Any such payments to Hamilton County or the city would also require approval from the TVA board."