House passes bill to phase out so-called 'death tax'

Friday, April 13, 2012

NASHVILLE - The state House on Thursday approved proposals to phase out Tennessee's inheritance tax by 2016 and lower the sales tax on groceries.

The inheritance tax legislation, which critics dub the "death tax," passed 88-8. Members then approved the sales tax measure, which reduces the levy from 5.5 percent to 5.25 percent, by 96-0.

Both bills now go to the Senate. Republican Gov. Bill Haslam has included them in his proposed 2012-13 budget.

While the inheritance tax passed the Republican-controlled House with bipartisan support, several Democrats questioned the fairness of moving to eliminate the inheritance tax, which brings in on average about $94 million a year.

The first phase of the proposal would increase the exemption on estates to$1.25 million at a cost of about $14 million. The second year increases the exemptionto $2 million. Year 3, which takes effect in 2015, increases the exemption to $5 million before eliminating the inheritance tax entirely in 2016.

House Democratic Caucus Chairman Mike Turner, of Nashville, questioned doing away with the inheritance tax, noting fewer than 1,000 estates annually versus reducing the sales tax on food, which would benefit 6.4 million people.

"I can't wait to see all the excited faces at the fire hall when they hear we eliminated the inheritance tax," scoffed Turner, a Nashville firefighter.

The focus should be on reducing the sales tax on groceries, Turner said.

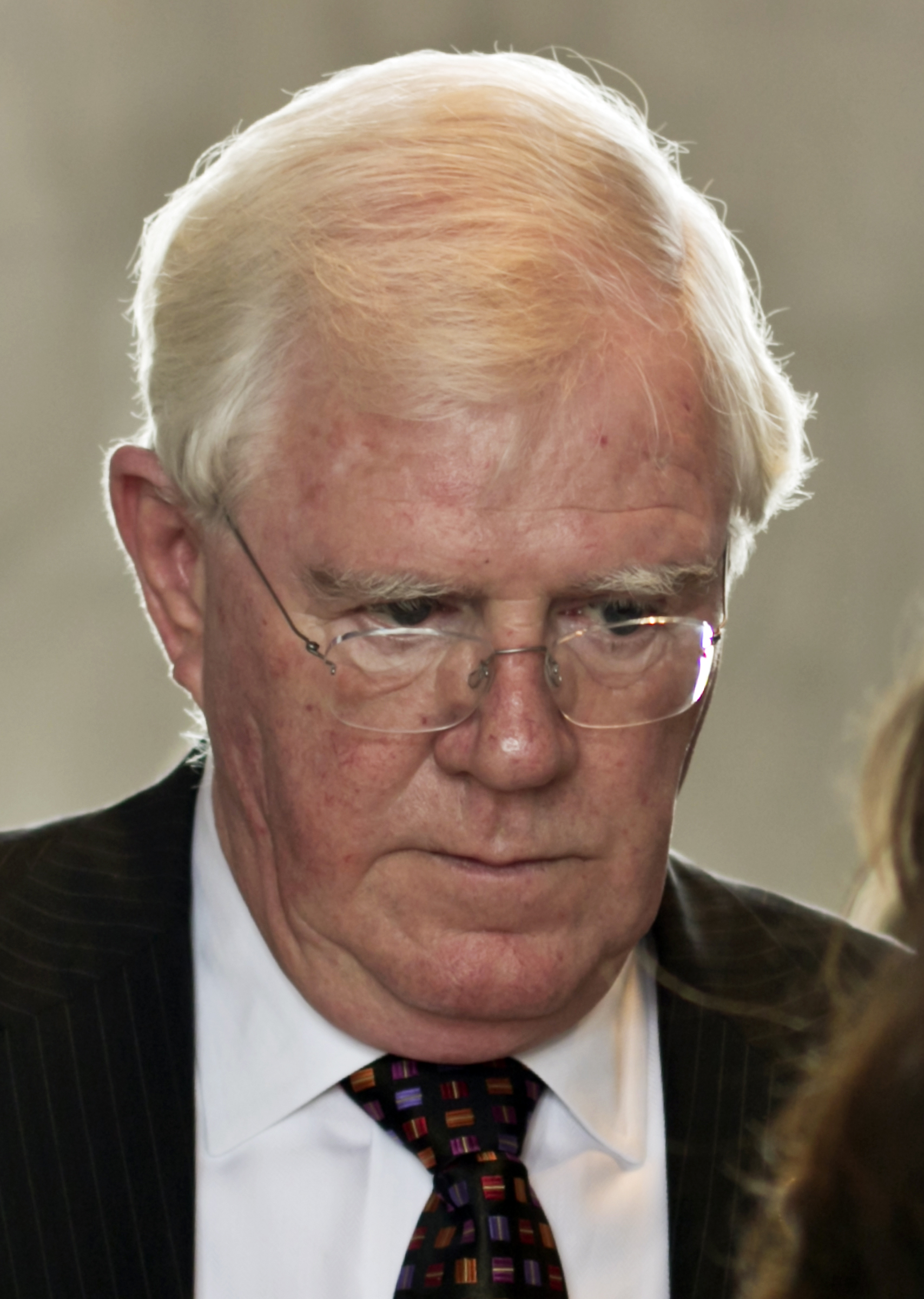

But the sponsor of the bill, Finance Committee Chairman Charles Sargent, R-Franklin, defended cutting and ultimately eliminating the inheritance tax, citing what he called a "multiplier" effect that includes wealthier retirees choosing to remain or relocate to Tennessee and spend money and invest in Tennessee.

Moreover, he argued, the tax cut will benefit multiple members of wealthy families and probably affect about 9,000 people a year ultimately. Sargent also said it would spare farm families from having to sell off their property when a parent dies.

Reducing the sales tax on groceries from 5.5 percent to 5.25 percent would result in a $22 million loss to the state.

Haslam intends to come back next year with another quarter-penny reduction, bringing it down to 5 percent at a total cost of $44 million over the two-year period.

Those voting for both bills included Majority Leader Gerald McCormick, R-Chattanooga; Rep. Tommie Brown, D-Chattanooga; Rep. JoAnne Favors, D-Chattanooga; Rep. Vince Dean, R-East Ridge; Rep. Richard Floyd, R-Chattanooga; and Rep. Jim Cobb, R-Spring City.