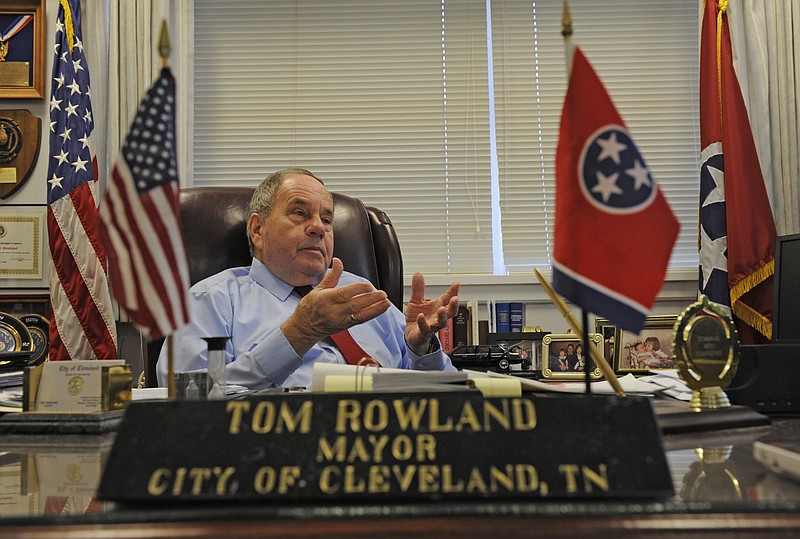

CLEVELAND, Tenn. - Mayor Tom Rowland on Tuesday vetoed a proposed change on how the city acquires bond debt that passed the City Council on Monday by one vote.

Councilman Bill Estes proposed that the City Council always seek bids from financial institutions that handle city bonds.

"There is no purchase we make that's more expensive than debt," Estes said.

In a memo Tuesday, Rowland said, "This is official notification of my veto to the vote that passed 4-3 on Monday, February 13, 2012, concerning a financial adviser."

"I feel the City Council needs more time to study the intent of the motion and it should be discussed at the budget retreat on March 12."

Estes' motion was that the city bid out all bond issues unless the council votes to suspend bidding on a specific issue. Estes, Charlie McKenzie, Avery Johnson and Dale Hughes voted for it. Three members voted no: David May, Richard Banks and George Poe.

Two weeks earlier the council awarded three bond issues to the Tennessee Municipal Bond Fund. Those bonds include a $1.5 million issue for the new airport, a $1.7 million issue related to connector roads to be built on APD 40 at a future interchange and a $1 million issue for road improvements around the new Whirlpool plant.

"This is what aggravated us about the school system," Johnson said. "We need to just bid it out. It's a fair process."

City practice dealing with bond debt has been a long-standing issue among council members.

Follow @DaltonGeorgiaIn June 2011 the council terminated its contract with Joe Ayers of Morgan Keegan as the city financial adviser.

City Manager Janice Casteel told Estes on Monday she plans to discuss a contract for a financial adviser as well as other cities' bond procedures at a March budget-planning retreat.

"I don't want to muddy the waters," Estes said. "Those are two separate issues."

Banks traced the controversy back to printed and blog articles about Morgan Keegan and another Tennessee city's financial woes. He also noted a federal court settlement last year involving a different division of Morgan Keegan from the division that dealt with the city.

"You don't have to go out of town for good financial advice," Banks said.

"I'm all for the bidding process." May said. "But I prefer to wait until the budget hearing and hash out the process."