John "Thunder" Thornton sues Chattanooga Ag Credit group to block foreclosure

Friday, January 1, 1904

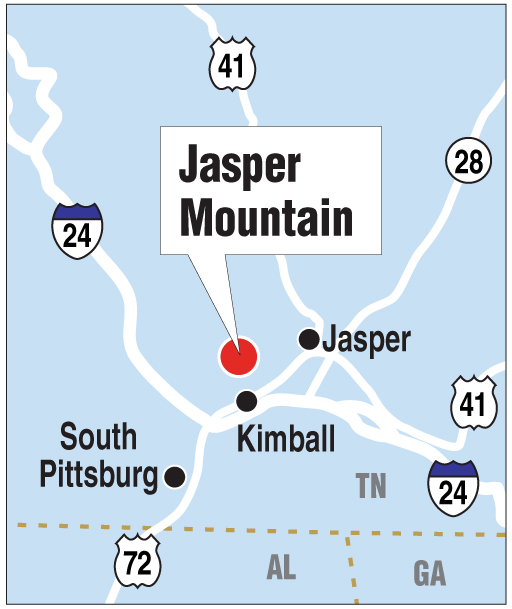

Chattanooga developer John "Thunder" Thornton is suing the lender that financed his purchase of Jasper Mountain to block a pending foreclosure of most of the Marion County mountain he wants to develop.

In a lawsuit filed Thursday in Marion County Chancery Court, Thornton claims that Chattanooga Agricultural Credit Association "acted in bad faith and with unclean hands" by initiating foreclosure action against Thornton's business just after he got approval to build a road up to Jasper Mountain.

The legal dispute between Thornton's Tango November LLC and the rural lending co-op won't affect the 560 acres Thornton now is developing as Jasper Highlands.

But the foreclosure fight could threaten future development of the mountain, including a potential vegetable-growing business that was looking at locating in the area.

"This has no impact on the first two phases of our development and sales are continuing to be strong," Thornton said Thursday. "We've had a fabulous response to the first phase of Jasper Highlands, which is why this action is so perplexing to us."

Thornton borrowed nearly $10.2 million from Chattanooga Ag Credit in January 2008 to acquire nearly 9,000 acres of Jasper Mountain in Marion County.

If fully developed, the property could include up to 3,200 homes and be bigger than Signal Mountain.

The 13-page lawsuit filed by Thornton's attorney, Bill Horton, acknowledges that "due to the severe economic downturn" the loan "has been in technical default." But Thornton said he has worked with the managers of Chattanooga Ag Credit to rework the loan and pay down some of the debt.

Thornton said he planned to repay the debt from Chattanooga Ag Credit, which finances only rural and agricultural property, with proceeds from the developing Jasper Highlands project.

"I am fully confident we would repay 100 percent of the loan" as the mountain ultimately is developed, Thornton said.

But after the farm owners of Chattanooga Ag Credit Services voted last month to merge with another ag credit service in Mayfield, Ky., to form River Valley Agricultural Credit Services, the lender moved to foreclose on Thornton's loan. A foreclosure sale is planned July 3 on the steps of the Marion County courthouse for the undeveloped portion of Jasper Mountain.

John Anderson, an attorney for Chattanooga Ag Credit, declined Thursday to discuss the loan or foreclosure action.

"Now that legal action has been initiated, we have no comment," Anderson said.

Thornton said he has been unable to talk with any officials of the Jackson Purchase Agricultural Credit Association in Kentucky, which will serve as the headquarters for Chattanooga Ag Credit after the merger is completed July 1.

Thornton said the foreclosure could devalue the property and hurt chances for a proposed 178-employee hydroponics business looking at locating greenhouses and an organic vegetable-growing business on the northern portion of the mountain.

"The foreclosure action isn't in the best interests of the bank or the community," said Dane Bradshaw, president of Thunder Enterprises who has worked on developing Jasper Highlands.

Thornton's lawsuit claims the mountaintop property is appraised at nearly $15.6 million, which exceeds the outstanding value of the loan. So far, more than 40 of the first 99 lots in Jasper Highlands have been presold for residential development, collectively valued at more than $2 million.

"We're working every day -- and even hiring more sales people -- to make sure that Jasper Highlands is successful and continues to grow," Thornton said.