Memorial Health Care System's contract with the state's largest health insurer expires in six weeks, and the hospital is asking the public to help in the dispute over reimbursement rates.

Memorial executives say their reimbursement from BlueCross BlueShield of Tennessee "significantly lags the market," but BlueCross counters that Memorial has asked for a reimbursement increase four times the rate of inflation, as the two sides jockey for advantage in ongoing negotiations.

The nonprofit hospital warns patients on its website that unless an agreement with the insurer is reached by July 31, Memorial and Memorial Hospital Hixson will be considered "out of network," which means patients will have to pay more for many services. The hospital asks on its website that people sign up as a supporter of Memorial as negotiations with BlueCross continue.

"We find ourselves unable to continue to function in this manner, and have requested that they work with us to restore our reimbursement to fair market rates," said Lisa McCluskey, Memorial's vice president of marketing communications in an emailed statement similar to a post on the hospital's website.

However, BlueCross executives counter that the insurer has offered the hospital an increase in reimbursement that is greater than the medical inflation rate of 4 percent.

BlueCross officials said Memorial has asked for a double-digit rate increase, with an even greater increase for some services, according to Roy Vaughn, vice president of corporate communications for the insurer.

"Memorial has been a partner for many years, and we will do everything we can to keep them within the network," said Roy Vaughn. "But our first priority is our customers and members."

Both sides say they hope an agreement will be reached before the contract expires July 31.

About 99 percent of Tennessee hospitals offer at least one BlueCross plan.

Memorial served about 2,700 BlueCross members in fiscal 2011, receiving about $104 million in net patient revenue, according to a provisional Joint Annual Report filed with the Tennessee Department of Health. The hospital has a contract for Network P, which is BlueCross' higher-cost network.

Insurers and hospitals renegotiate rates periodically, often every three to five years.

Exact contract negotiations or reimbursements are protected, but all Tennessee hospitals file reports that reveal how much they bill BlueCross and how much they receive in net revenue from those charges.

McCluskey said Memorial has done a study that shows it is paid less than other hospitals.

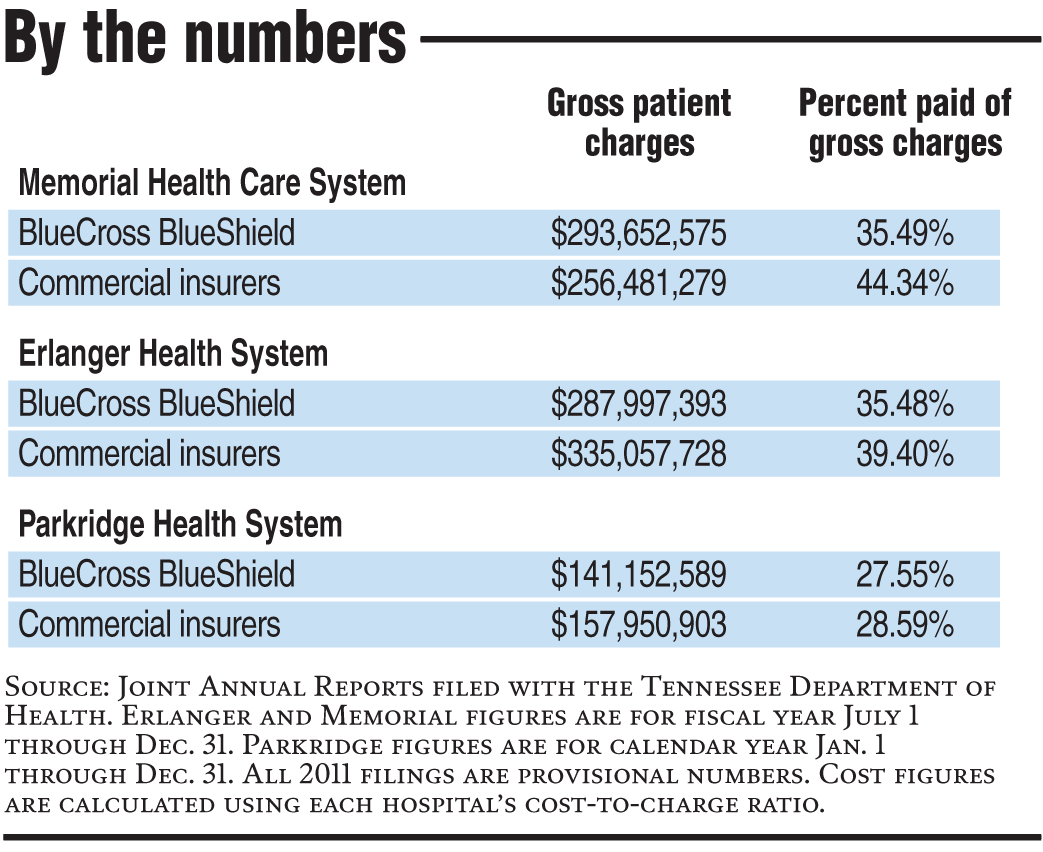

According to Memorial's Joint Annual Report filed for fiscal year 2011, the hospital was paid 35 percent of gross charges it billed BlueCross, a rate almost identical to Erlanger Health System's rate.

The reports show both hospitals received lower reimbursement rates from BlueCross than from other commercial insurers. In fiscal 2011, Memorial received 44 percent of its gross charges billed to commercial insurers, while Erlanger received 39 percent.

Parkridge Health System, the area's for-profit hospital, had lower reimbursements rates from BlueCross than Memorial or Erlanger.

The rates in the Joint Annual Reports show what percent of gross charges a hospital received for that year, but do not reflect an exact rate negotiated with insurers, according to Mary Layne Van Cleave, chief operating officer at the Tennessee Hospital Association.

Hospitals usually negotiate different rates for inpatients and outpatients and for specific services. The numbers reported in the Joint Annual Report only represent the mix of services used that year, which can vary greatly from year to year, Van Cleave noted in an email.

Hospitals also charge different prices for the same service, which plays a role in what type of negotiated rates they get from insurers.

Although the figures vary from year to year, both Memorial and Erlanger have seen a decrease in the percentage of gross charges they were paid over the last four years, the Joint Annual Reports show. However, Memorial's profit from those charges have increased over the last four years, due to a difference in the actual cost of services provided.

The reports only provide information on BlueCross separately; all other commercial insurers are lumped into one group.

In her statement, McCluskey said BlueCross has reduced Memorial's reimbursements through changes in BlueCross payments.

"BlueCross has not agreed to fair rate increases to keep up with the cost of delivering the quality of care that patients expect from Memorial," she wrote.

It is true that BlueCross has decreased aggregate payments for Network P, Vaughn said. But that is because members are shifting to lower-cost Network S and using their health insurance less, not because BlueCross pays less.

Vaughn said when BlueCross negotiates a rate, it looks at commercial insurers and how much it costs a hospital to provide a service.

"We are competitive, but we aren't interested in paying more than we have to," Vaughn said. "We try to strike a balance between what is fair for the market and vigilantly working to deliver the best value for our customers."

Both Memorial and BlueCross said they will continue to negotiate in the next month. Vaughn said they are also working with Parkridge and Erlanger to ensure their members will receive services if the negotiations fail.

On its web posting, Memorial asks people to email the hospital to show support of their "efforts to reach a fair contract with BlueCross."