Buoyed by a 9.9 percent gain in home sales during the first quarter, Chattanooga home prices appear to have bottomed out from their recession lows.

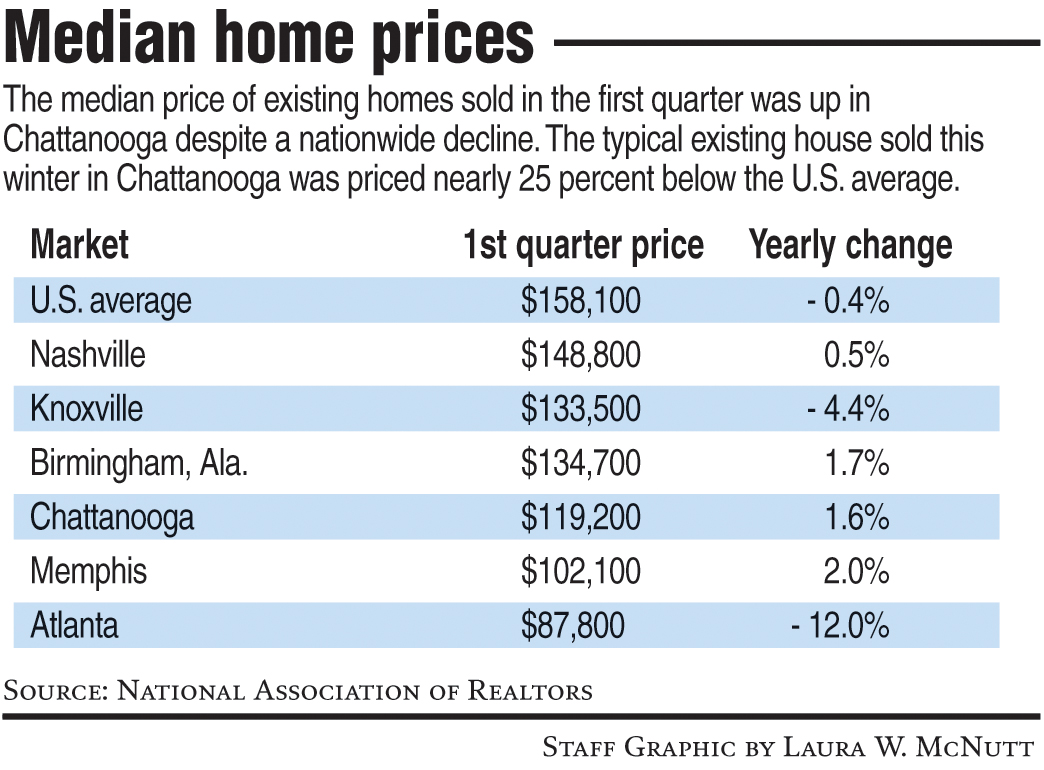

Despite a nationwide decline in home prices this winter, the median price of existing, single-family homes sold in Chattanooga during the first quarter was up $1,500 from a year ago, according to a new report from the National Association of Realtors. The typical home sold this winter in Chattanooga for $119,200, or 1.6 percent more than in the same period a year ago.

"I think we're in the trough of this downturn and the worst is behind us in Chattanooga," said Randy Durham, a Realtor at Keller Williams Realty and a former president of the Greater Chattanooga Association of Realtors. "We have a very good stream of buyer activity now, and I think we'll continue to see that through the summer."

In the first three months of 2012, local Realtors sold 1,324 homes, or nearly 10 percent more houses than were sold in the first quarter of 2011. The average home sold this winter in Chattanooga in 143 days, one day shorter than in the year-ago period, according to the Greater Chattanooga Association of Realtors.

The market is benefiting by the decline in unemployment and mortgage rates.

In the past two years, the jobless rate in the Chattanooga area has dropped from nearly 10 percent to below 8 percent.

Last week, mortgage buyer Freddie Mac said the average rate for a 30-year loan dipped to 3.79 percent, the lowest since long-term mortgages began in the 1950s. The 15-year mortgage declined to 3.04 percent, down from the previous week's record of 3.05 percent.

"Home affordability is as strong as I have ever seen," said Don Oakes, president of Mortgage South in Chattanooga. "We are doing some 15-year mortgages under 3 percent and 30-year loans at 3.62 percent, and that's causing some buyers to get back in the market."

Median home prices also are still are well below the levels reached in 2005 and 2006 before the housing slump cut sales and prices of most houses.

"For those with good credit, we've never seen better housing affordability conditions or market opportunities than we see at present," said Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami, and president of the National Association of Realtors.

The Realtors affordability index, which measures the price and financing costs for buying a home, rose last month to a new high.

Qualifying for those cheaper loans isn't as easy as it was five years ago, and the economic slowdown and drop in home prices has still left many home buyers cautious about the market.

"But with the investments here we've seen from Volkswagen, Amazon, Alstom and others, I really think Chattanooga is doing better than most markets," Durham said.

Chattanooga home prices didn't rise as much as they did in many markets prior to the recent housing slump. But local home prices also didn't fall as much during the downtown of the past four years.

The median price of a home sold in Chattanooga in the first quarter, $119,200, was nearly 25 percent less than the U.S. median price of $158,100.

But Chattanooga median home prices have moved ahead of struggling markets like Atlanta. In Atlanta, median prices of existing homes sold in the first quarter of 2012 were down by more than a third from before the housing slump, falling another 12 percent in just the past year to only $87,800 in the first quarter of this year, according to the National Association of Realtors.