Black-owned businesses triple in decade, but still lag in market share

Friday, January 1, 1904

Read moreSupplier diversity programs aid minority-owned firms in Chattanooga

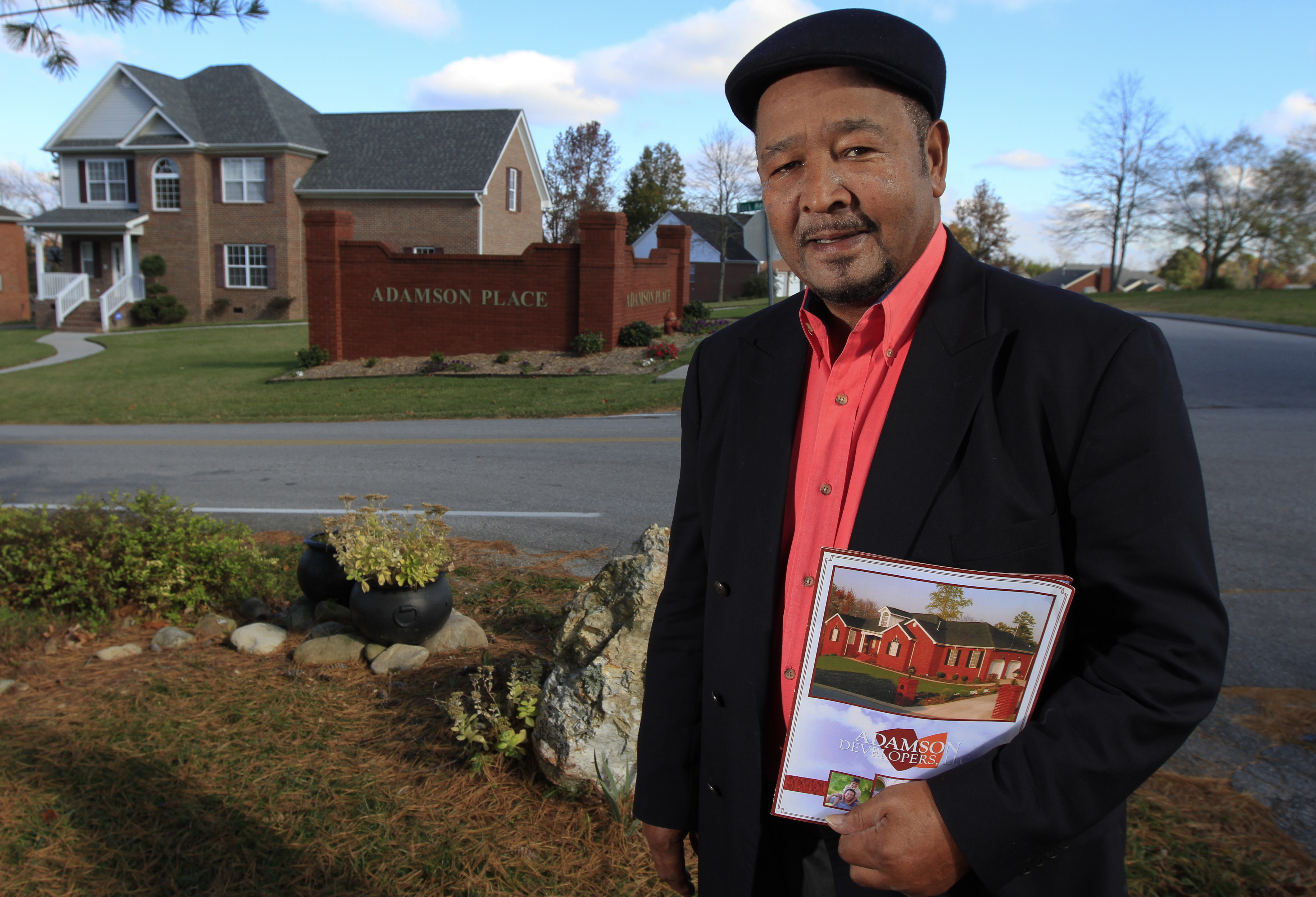

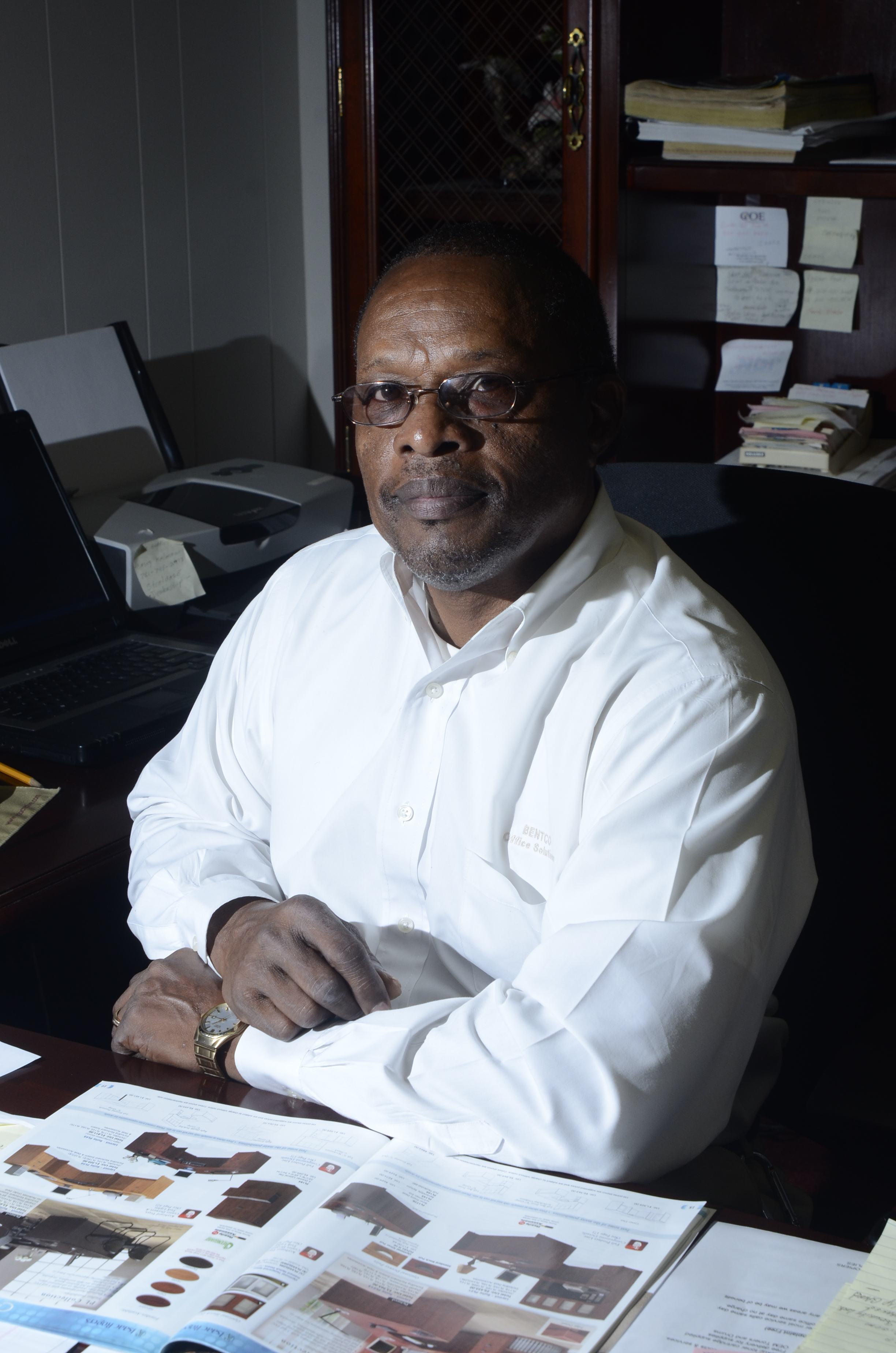

BLUE ORLEANSFounded: 2007Owners: Mike and Cherita AdamsMission: To serve authentic Creole and New Orleans-style foodNumber of employees: 10Why Chattanooga:"For us it just made sense because we're from New Orleans. We moved [here] right after Hurricane Katrina. A lot of people told us in the beginning that Chattanooga wasn't sophisticated when it came to culinary diversity, but thank God, that's been proven wrong. Chattanoogans love New Orleans food." -- Cherita AdamsADAMSON DEVELOPERSFounded: 1993Owner: Bobby AdamsonMission: To build residential and small commercial buildings as general contractorsNumber of employees: 8Why Chattanooga:"I live here. The woman I married has her teeth dug into this area. I'm not going to leave her, so I can't leave the city." -- Bobby AdamsonALTON PARK RECYCLEFounded: 1980Owner: Charles ClayMission: To recycle and re-purpose manufacturing waste, especially wooden palletsNumber of employees: 5-6Why Chattanooga:"The pallet industry, for the most part, was in my neighborhood [Alton Park]. I help others who can't help themselves. I hire people the mainstream won't hire, like guys with records. I train them to do well and give them an opportunity to do something." -- Charles ClayC.J. ENTERPRISES INC.Founded: 1980Owner: Carolyn JonesMission: To provide information management and administrative servicesNumber of employees: Up to 100Why Chattanooga:"We've done 95 percent of our business outside of Chattanooga. We have covered approximately 40 states, but our business opportunities in Chattanooga have not been as great as we would like them to be." -- Carolyn JonesBENTCO OFFICE SOLUTIONFounded: 1995Owner: Edward BentleyMission: To offer a minority-owned, fully-certified office supply company to help other companies meet diversity requirementsNumber of employees: 5Why Chattanooga:"I am a native of Chattanooga. I went out on faith that I could run my own office supply company and help fill that diversity need. I really felt that OK, TVA has a diversity program, BlueCross has a diversity program, these people hired diversity managers. I said, 'Surely I can do business with these guys.' " -- Edward Bentley

When Edward Bentley started his company in 1995, he was listening - and what he heard sounded like a great business opportunity.

Major Chattanooga companies said they wanted to work with minority-owned suppliers. So, he thought, he'd create an office supply company to fill that niche and help businesses meet their diversity requirements and goals.

Seventeen years later, he's struggling to keep his doors open, and he's tired of listening.

"Most companies here say, 'We want to do this,' but they don't -- it just doesn't happen," he said. "I do no business with the city of Chattanooga. I do no business with Hamilton County. I do no business with most of the large businesses here. We just keep hearing, 'We're trying.'"

Historically, black-owned businesses have made up a relatively small share of all Hamilton County's businesses. While the number and share of black businesses is steadily growing, Chattanooga still lags behind the biggest cities in Tennessee and Georgia.

"Chattanooga is one of the areas that needs to do a lot of catching up, versus say a Memphis or a Nashville," said Nicole Burney, entrepreneurship center program director at the Urban League of Greater Chattanooga. "Although those areas are larger and have more minority individuals there to start businesses, Chattanooga is just one of the last cities to see growth in that area."

In 1997, just over 2 percent of businesses in the Chattanooga metropolitan area were owned by blacks. That number grew to about 5 percent in 2002, and was up to nearly 7 percent in 2007, according to the latest U.S. Economic Census data.

Although the share of black-owned businesses more than tripled in the most recent decade that the government has such data, black Chattanoogans still are only half as likely to own their own businesses as are white Chattanoogans. African-Americans comprised 14.1 percent of the population of metro Chattanooga in 2010, according to the U.S. Bureau of Census.

The Chattanooga metro area includes Marion, Hamilton and Sequatchie counties in Tennessee and Catoosa, Dade and Walker counties in Georgia.

Memphis, Nashville and Jackson each had a higher percentage of black-owned businesses in 2007 than Chattanooga, according to U.S. Economic Census Data. In metro Atlanta, African-Americans make up 32 percent of the metro area population and own 23 percent of businesses.

Bentley said people often tell him to move his business to a different city.

"A lot of people say go to Atlanta," he said. "I questioned that. The reason I stay in Chattanooga is because it is my home. All my family is right here. I started out right here. Why is it that I have to leave my home and go somewhere else to be successful?"

CHALLENGES: A CAPITAL ISSUE

In 1994 Bobby Adamson was a year into his construction venture and he was stuck. No one would give him the $300,000 loan he needed for Adamson Developers' next project.

"I went to bank after bank after bank -- and everybody said no," he said. "Finally, I talked to a lady I had known for a while who happened to work at a bank. After about six months she finally talked her boss into giving me a loan to develop Adamson Place."

Adamson used the loan to cut roads and prepare 13 acres of land for development. He named the new roads after his children and built 22 houses on the spot. He sold each one.

"It was very successful," he said.

Adamson's initial struggle to secure a loan illustrates the most common problem that prevents minority-owned businesses from starting and growing, said Shelia Simpson, program director at the Governor's Office of Diversity Business Enterprise. Finding working capital is a challenge for all small businesses, but it is especially difficult for small black-owned businesses, she said.

"You need something to back you up besides your good idea," she said. "The trend for the African-American community is that they just were not afforded capital at the same pace of other groups."

Burney said it's a problem she sees over and over.

"An entrepreneur will walk in the door with a great idea and a completed business plan, but then once they try to get to that next step and get financing -- that's the biggest challenge," she said. "Either they don't have the credit or they don't have the collateral that lending institutions require."

BREAKING INTO BUSINESS

But other minorities have found Chattanooga much more hospitable to their business ventures.

When Cherita Adams and her family moved to Chattanooga after Hurricane Katrina destroyed their New Orleans home in 2005, she felt like Chattanooga rallied to help her start a downtown Creole restaurant, she said.

"What we heard time and time again was how much Chattanooga wanted to keep us here," she said. "If there was red tape, they were cutting it. They believed in us."

Many successful black business owners in Chattanooga can point to one moment, person, certification, grant or organization that kick-started their success.

For Adams, it was the guidance offered by the Lyndhurst Foundation and Chattanooga Neighborhood Enterprise.

"I would honestly say without those two organizations holding our hands all the way through, we couldn't have done it," she said.

For Carolyn Jones, who founded C.J. Enterprises, it was earning a Small Business Administration certification from the federal government.

"It was very, very vital," Jones said. "You still had to compete and be good, but the certification at least opened the door for you to get a federal contract."

For Thomas Rumph, a Chattanooga dentist, businessman and landlord, the light bulb clicked on when he joined real estate investor groups.

"I would say that 70 percent of my growth occurred within the last six years, when I started going to real estate investor meetings and learning how people acquire real estate," he said. "It was the only avenue I had."

Simpson said small businesses and minority-owned businesses in particular often need someone to guide them through the start-up process. "Some business industries have built-in barriers," she said. "If you have somebody to help guide you, you are more likely to be successful."

But often, Rumph said, black entrepreneurs have a harder time finding that guidance than others.

"Perhaps one Caucasian person has five people to ask how to do it, whereas when it comes to the average black person, it's hard to find that one person you can ask," he said. "And the last thing you want is a new recruit teaching a new recruit how to fight."

Maria Noel, director of minority business assistance at the Chattanooga Area Chamber of Commerce, said it's important to look at the big picture.

"The traditional methods of doing business do not exist for African-American and other minority businesses," she said. "For example, we've not always had those business relationships with the broader, more affluent communities."

Bentley said building relationships is easier for businesses such as hair salons, restaurants or cleaning companies that serve the community directly. It's harder, he said, in a business-to-business environment.

"I'm not the guy on the golf course. I'm not the guy in the country club, and I'm not the guy that hangs out on the yacht," he said. "But I am the guy who comes to your front door with an excellent product, competitive pricing, 39 years of experience and an experienced crew to get the job done."

BETTER THAN BEFORE

Despite the challenges, there's no doubt the number of minority-owned businesses in the Chattanooga area is increasing. There were 857 black-owned businesses in the Chattanooga metro area in 1997. Ten years later, those numbers jumped to 3,167 black-owned firms.

"Looking at the population growth and looking at Chattanooga as a whole -- the changes, the different opportunities, the people we have recruited from other cities and people who moved into Chattanooga -- I would expect [the number] to increase, and I actually would expect it to continue to increase," Noel said.

J.Ed. Marston, vice president of marketing and communications at the Chamber, said he thinks the recent increase is a result of decades of steady progress.

"I think you are also seeing a crude value of several decades of greater access to educational opportunities and a number of other things that became easier in the late '60s or early '70s," he said. "The advantages of those things start to have a greater and greater impact over time."

Still, local black business owners say Chattanooga has a long way to go.

"We all can look around our city and see that our African-American business community is not all that it could be or should be," Bentley said. "And it's because of non-inclusion. It's not that we're not here; we're just not included."

Many of Chattanooga's large employers have programs aimed at including minority-owned businesses in their buying processes, but Bentley said he thinks large firms need to be more proactive.

"They say they're trying, but sometimes the product they might buy from Staples might be $10 and my product might be $12," he said. "And they won't do it. But that's what you've got to do if you intend to support minority-owned businesses."

At BlueCross BlueShield, the director of procurement, Steve Henderson, is responsible for buying all the goods and services the insurer needs for day-to-day operations -- from pencils to computer servers -- and every bid is required to include at least one minority or small-business supplier.

So far this year, BlueCross has spent about 27 percent of its annual procurement budget in Tennessee with diverse-owned or small businesses, Supplier Diversity Manager Jac Blanco said. The company does not track local statistics.

Noel said that an increased focus on utilizing diverse suppliers has become a nationwide trend in recent years.

"This is something nationally that has increased with a number of Chambers (of Commerce) in a number of cities," she said.

Blanco said the goal of BlueCross's 10-year-old diversity program is to give small or minority-owned businesses a fighting chance.

"Obviously business priorities come first," he said. "So there's no guarantee the minority-owned suppliers will get the business; it's really a way for them to put a foot in the door. They still need to prove themselves and come in with good pricing."

CATCHING UP

Some black business owners believe growing black-owned business in Chattanooga will help slow the spread of gang violence.

"The youth feel that we have nowhere to go," Bentley said. "They think, 'If I go to school and graduate high school and college and come back to my hometown -- where I live and I was raised and I paid taxes -- and I get a business license and set up, I'll go out of business.' And that's what's happening."

But others tell a far different story. Adams said her experience in Chattanooga has been better than her business experience in New Orleans, and she doesn't want to leave Chattanooga.

"What we're trying to do is a lot more possible in Chattanooga," she said. "Chattanooga lets you grow slowly into an empire and allows you to perfect your business model. They're willing to allow you to shape it in the way you want it to be, whereas I don't think that would be true for another city."

Rumph said the local black community can succeed in business with access to the right information. He created a weekly radio show to highlight successful, local black entrepreneurs. "I thought it was time to have a show that represents the 98 percent of black people who are concerned about Chattanooga, who work hard for a living and take care of their families," he said. "Because very seldom do you hear the voice of accomplished blacks."

He hopes the broadcasts will encourage and help equip other minority entrepreneurs to enter the marketplace.

"The organizations are out there," he said. "The main thing is to get the knowledge as to how to go about doing it."

The Chattanooga area offers several organizations to help budding entrepreneurs, including the Urban League of Greater Chattanooga, the Tennessee Minority Supplier Development Council and the Chattanooga Area Chamber of Commerce.

Noel said she works to bring minority business leaders and pro-business organizations together.

"What I've learned is that most people don't even know about all of the resources we have," she said. "We need to plug people into the resources we have and make them aware of the agencies whose prime mission and passion is to assist them in business development."

Another goal the Chamber aims for is to connect minority-owned businesses with other Chattanooga businesses, Marston said.

"We have 1,700 member companies ranging from the largest employers to many small businesses, representing thousands of social contacts," he said. "That's a tremendous opportunity for African-American and other disadvantaged businesses to plug in and get to know others."

Simpson said she's encouraged by Chattanooga's minority-business atmosphere.

"We are always encouraged when it comes to the growth of minority-owned companies," she said. We know they have their challenges, but they also tend to be strong and enduring."

Rumph is glad to be in Chattanooga, he said.

"You have to make a city be what you want it to be," he said. "Have I had problems? Have I had challenges with banks? Yes, I have. But you stick with it, and you work hard. And once you prove yourself, you can pretty much do what you want to do."