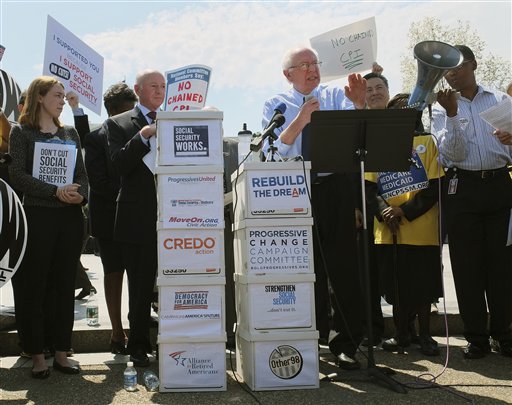

In a bid to entice Republicans into a budget compromise, President Obama has proposed to switch the basis for cost-of-living adjustments for Social Security benefits to what's known as the "chained Consumer Price Index." This amounts to an unreasonable and unfair cut in Social Security benefits. Whatever he thinks he can trade for this cut, Obama's on the wrong path.

When Democrats propose to help lower the federal deficit by eliminating special-interest corporate tax loopholes, Republicans always object, and always filibuster to block such proposals in the Senate. They say eliminating sweetheart tax loopholes to gain revenue to offset deficit spending would be wrong, because abolishing these cleverly lobbied giveaways would amount to raising some corporations' taxes -- even if, as is often the case, many of the nation's largest and most profitable corporations pay no federal income taxes at all, and many even qualify for future tax credits.

But when it comes to Social Security for current and future retirees, Republicans are all over the chained CPI, which is essentially a benefit cut and/or a tax increase that falls most heavily on the nation's broad middle class. These are the very taxpayers who badly need the current benefit structure they have been promised, because their yo-yo 401(k) savings -- if they have any -- fall far short of the fixed-benefit pensions that flush corporations have largely dropped.

The "chained CPI" differs from the traditional Consumer Price Index -- the long-held standard for cost-of-living adjustments (or COLAs) -- in an ingenious way. The standard CPI used to determine COLA increases in annual Social Security benefits measures the price change in a basket of consumer commodities. The chained CPI, by contrast, effectively reduces COLA increases because it measures adjustments that consumers make in categories of spending when selected costs rise.

If the price of particular food items or gasoline rise, for example, consumers may curb their spending on groceries and ride a bus. They hold down their regular cost-of-living by substitution or buying less, and the chained CPI measures the spending adjustment that reflects that chain of economic decisions.

Switching to the chained-CPI, the Congressional Budget estimates, would lower future inflation-adjusted increases in Social Security benefits over the next decade by roughly $135 billion. That, in effect, is simply a cut of $135 billion in currently projected benefits from Social Security. Worse, the cuts in future decades would become exponentially higher as the compounding effect of lower cost-of-living increases snowballs downward.

If these lost benefits were to occur under elimination of a corporate tax loophole, Republicans would never entertain it -- even for the richest corporations. But talk about a big cut in Social Security benefits for the middle class, and they would do it a heartbeat, never mind the tax inequity. They want to cut earned entitlements for the middle class -- the more the better to keep their corporate donors' campaign contributions coming. Unfortunately, middle-class Americans don't have much financial ability to win Republicans to their core economic interests.

The chained CPI formula would especially hurt seniors and disabled veterans, because the majority of these recipients live on tightly fixed incomes and cannot make the sort of budget substitutions that many working families can make. Their core costs for prescription drugs and health care rise faster as they age, and consume so much of their income because health care costs typically rise at double the rate of inflation in other commodities.

Some analysts believe that Social Security recipients need a higher COLA formula, not a lower one. That's not to say that some Social Security and entitlement reforms are not needed. They are. Some examples: removing the income cap on Social Security withholding taxes; gradually raising the eligibility age for Social Security at top income levels; and means-testing Medicare recipients.

Obama is wrong to think he must offer a devastating Social Security benefit cut in which three-quarters of the burden would come from people who make less than $200,000. Republicans would grab it, but it wouldn't push them toward a fair budget compromise.