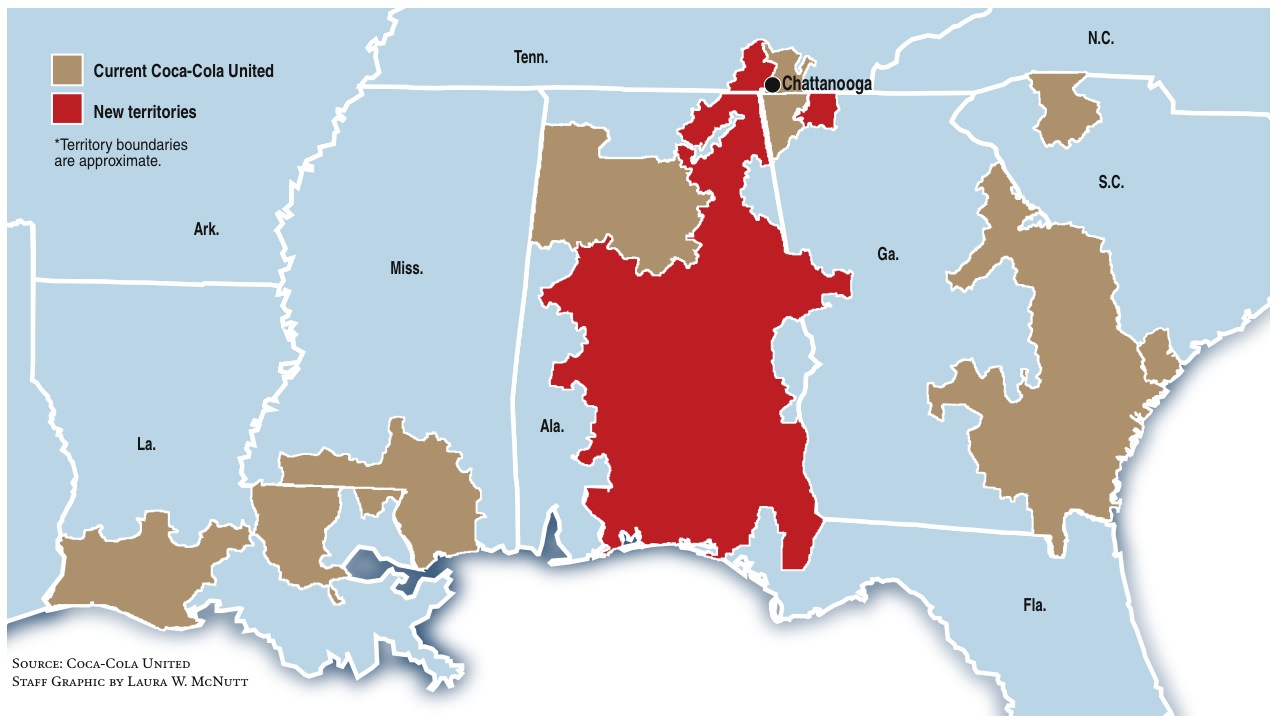

HOW DOES BOTTLING WORK?Coca-Cola is not a single entity, and the Coca-Cola Co., does not own or control all its bottling partners.While many view the company as simply "Coca-Cola," the system operates in tiers.Atlanta-based Coca-Cola manufactures and sells concentrates, beverage bases and syrups, owns the brands and is responsible for consumer brand marketing.Bottlers, like the Chattanooga Coca-Cola Co., manufacture, package, merchandise and distribute the final branded beverages to retailers and vendors -- grocery stores, restaurants, street vendors, convenience stores, movie theaters and amusement parks -- who then sell the drinks to consumers at a rate of more than 1.8 billion servings a day.Source: The Coca-Cola Co.New Territories for Coca-Cola United, which owns Chattanooga Coca-Coca Bottling:• Dothan, Ala.• Montgomery, Ala.• Oxford, Ala.• Scottsboro, Ala.• Tuscaloosa, Ala.• Pensacola, Fla.• Valparaiso, Fla.• West Point, Ga.Source: Coca-Cola United

Coca-Cola is shaking up the bottling empire that began in Chattanooga, as independent bottlers start to swallow chunks of territory that formerly were controlled by The Coca-Cola Co.

"A strong franchise system has always been the competitive advantage of the Coca-Cola business globally," said Muhtar Kent, chairman and chief executive officer of The Coca-Cola Co.

As part of a deal between Coke and its bottlers, the Chattanooga Coca-Cola Bottling Co. will take on additional responsibility for new territories in the Chattanooga region.

"Chattanooga Coca-Cola, the first Coca-Cola bottler in the world, will be part of the united team that continues to build our business based on a high level of service," said Darren Hodges, vice president of Chattanooga Coca-Cola Bottling Co. "We are very fortunate to be part of a company that has a local operating model. This means that we are responsible for serving our local consumers and customers, and as importantly, supporting our communities."

Coca-Cola United, the Birmingham, Ala., bottler that owns the Chattanooga Coke plant, will increase its territory by 45 percent when the deal closes in the second quarter of 2014, growing its empire to form a contiguous mass instead of a scattered series of landlocked islands, said Claude Nielsen, chief executive officer of Coca-Cola Bottling Company United.

"We'll have the benefit of the efficiency, of the scale of having those acquisitions be contiguous to Chattanooga operation," Nielsen said.

Nielsen declined to discuss the terms of the deal, which he said will create the second-largest independent bottler in North America, and largest privately held bottler in North America.

It's also too early to discuss potential layoffs or plant closures, Nielsen said. However, Coca-Cola's stated long-term goal is to clean up the messy patchwork of territories and soft drink factories that have been created over the years, which will require closures and consolidations, as well as new plants.

In an interview with The Associated Press, Coke's CEO noted that the company has been working to fix a production network in the U.S. that hadn't been "well thought out." For instance, Kent noted that many bottlers didn't have the capacity for making its newer, non-carbonated beverages, which often results in third-party operators producing them.

"There's room for costs to come down," Kent said. "There's room for efficiency to increase."

As part of the effort, Atlanta-based Coca-Cola Co, which also makes Sprite, Dasani and Powerade, is moving to re-franchise vast swaths of territory to the nation's five biggest bottlers. Coke's decision to parcel out territory on independent bottlers comes on the heels of a move Coca-Cola made in 2010 to buy its biggest bottler, Coca-Cola Enterprises. Much of the territory now being distributed by Coke formerly belonged to CCE.

Aside from Coca-Cola United, the other four big U.S. bottlers are Coca-Cola Bottling Company Consolidated, Swire Coca-Cola USA, Coca-Cola Bottling Company High Country and Corinth Coca-Cola Bottling Works.

Coca-Cola Bottling Co. Consolidated, one of the big bottlers that descended from the original empire created in Chattanooga by the Lupton family, will also see its territory expand.

Chattanooga forms the northern boundary for Coca-Cola United, while Coca-Cola Bottling Co. Consolidated, manages territory to the north of the Scenic City. That territory will now expand to include Knoxville, as well as Lexington, Ky., and Louisville, Ky., said J. Frank Harrison III, chairman and CEO of Coca-Cola Bottling Co. Consolidated.

The agreement, under which Harrison's company will pay Coke to bottle and distribute drinks in additional parts of Tennessee and Kentucky, notably does not include any production facilities, according to a news release.

"We are very excited about this growth opportunity for our company, The Coca-Cola Co., and the U.S. Coca-Cola System," Harrison said. "Working closely with The Coca-Cola Co. and our U.S. bottling partners, we believe that we are well-positioned to help drive increased value in the Coke System."

Traditionally, the franchising model lowers overhead costs for Coca-Cola because it means regional bottlers take on the responsibilities for delivering drinks to retailers such as supermarkets and gas stations. Although Coca-Cola doesn't book beverage sales from franchised territories, it gets fees from the bottlers.

Coca-Cola says it has 69 independent bottlers. According to the industry tracker Beverage Digest, the deals announced Tuesday mean the company will end up handling about 74.5 percent of its U.S. bottling business, down from 79.4 percent.

Although Coca-Cola is giving more distribution territories to bottlers in the new deals, the company is holding onto its factories as it works to create a national production model more akin to those in other countries. The company will likely try to swap expanded territories for control of the remaining plants owned by bottlers, according to an analyst with Bernstein Research.

Rival PepsiCo Inc., which bought two of its largest bottlers in 2010, has also been consolidating production and plans to provide an update on a potential restructuring of the unit early next year, with possibilities including refranchising or a spin-off of the business.

Coca-Cola declined to set a timeline for when it will complete its U.S. refranchising. But Kent did say that the U.S. market would come to represent some of its best practices in the world in four or five years.

"(Bottlers) won't have to worry about supply and production planning," said Steve Cahillane, who heads Coca-Cola's Americas division. He noted that the changes are a way to "create drinks with one brain."

Meanwhile, Coca-Cola said global volume during its first quarter rose 4 percent, with Thailand, India and Russia posting strong gains. In its flagship North American market, volume rose 1 percent, fueled by growth in non-carbonated drinks such as Honest Tea and Simply Orange juice.

But soda declined 1 percent in the region, reflecting a continued movement away from soft drinks in developed countries such as the U.S.

For the three months ended March 29, the company said it earned $1.75 billion, or 39 cents per share. That's down from $2.1 billion, or 45 cents per share, a year earlier.

Not including one-time items such as restructuring charges, however, the company says it earned 46 cents per share. That's better than the 45 cents per share analysts expected.

Net revenue declined to $11.04 billion, from $11.14 billion a year ago, hurt by foreign currency exchange rates and two fewer selling days in the period. Analysts expected $10.97 billion, according to FactSet.

The Associated Press contributed to this report.