VIDEO

This story is featured in today's TimesFreePress newscast.

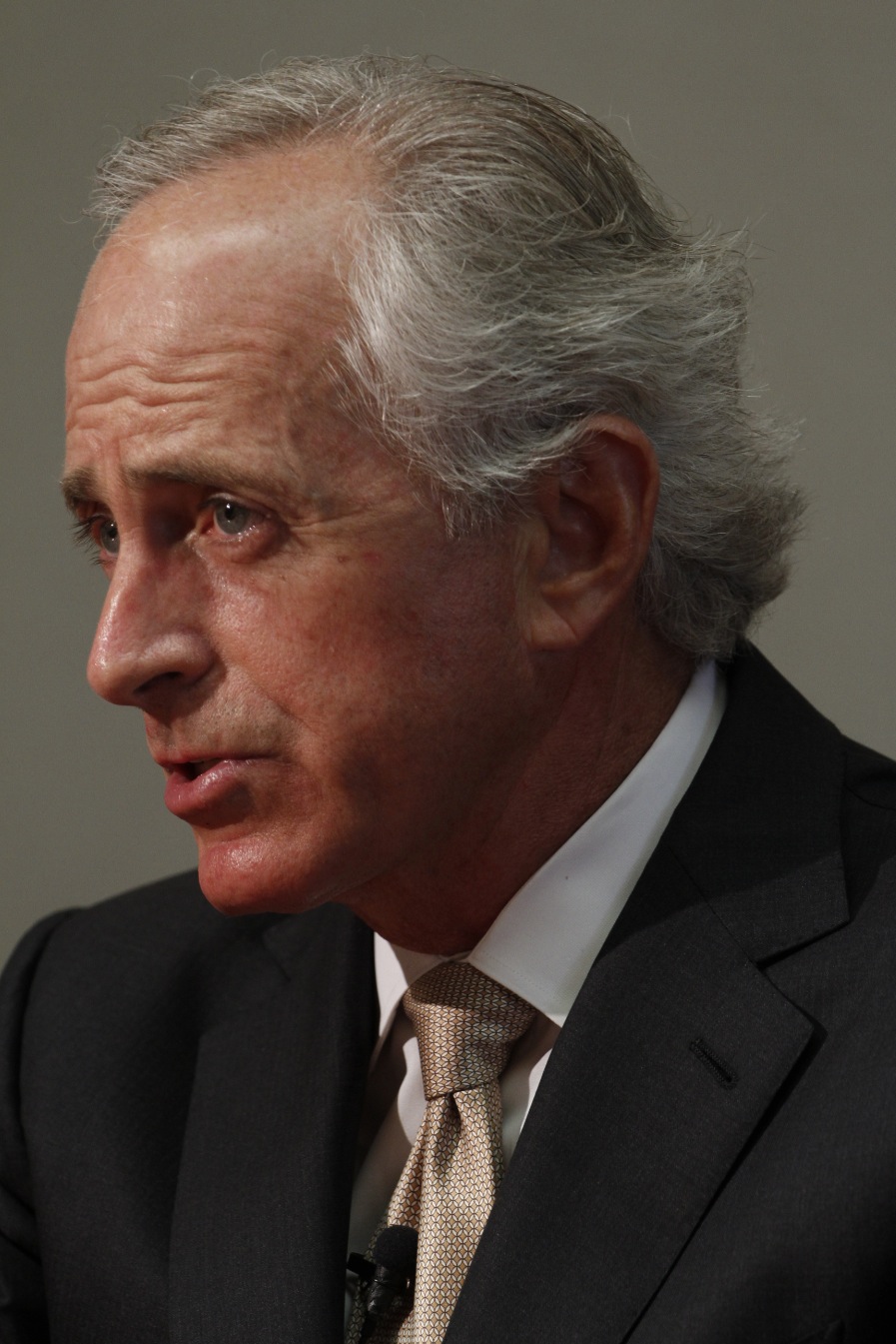

U.S. Sen. Bob Corker, R-Tenn., is welcoming President Barack Obama's expected announcement today in which the president will push to overhaul mortgage finance giants Fannie Mae and Freddie Mac, slash taxpayers' risk in future financial meltdowns and ultimately move to replace the two entities.

Speaking today with Times Free Press editors and reporters, Corker cited his own year-long, bipartisan work with U.S. Sen. Mark Warner, D-Va., to address Fannie Mae and Freddie Mac issues and said he believes it "gave the White House the sense that housing financial reform is doable."

The Republican-led House appears engaged, Corker said, and he believes the pieces may be coming together for action.

It "gives me hope that we actually deal with Fannie and Freddie before the political season begins this January and makes it very difficult for anything to occur," Corker said. "I'm pretty optimistic right now."

Corker's own proposal would move to eliminate Fannie Mae and Freddie Mac, which are government-sponsored enterprises that wound up having to be bailed out at taxpayer expense during the financial crisis. The two GSEs are on better footing now and stand to pay back those loans.

The senator said there was always an "implicit guarantee" the federal government would rush to the two entities' aid in a crisis and that became explicit in 2008. Corker said his proposal would create a new entity and require the loans it backs to be capitalized up front at 10 percent when the housing mortgages are sold on.

Had there been a 5 percent capitalization requirement, the bail out would never have been needed, Corker said.