The road to recovery still has some bumps for America's biggest asphalt equipment maker.

But Astec Industries Inc. said Tuesday it still boosted profits during the second quarter by 17 percent and, after a slowdown this fall, the company expects to see a better road ahead by year end.

The Chattanooga-based asphalt and construction equipment maker earned $11.1 million, or 48 cents per share, on sales of $248.1 million during the spring quarter. A year ago, Astec earned $9.5 million, or 41 cents per share, on sales of $238.3 million.

Analysts who follow Astec had projected, on average, the company would earn 55 cents per share in the second quarter.

Astec's stock dipped by 6 cents per share, or 0.16 percent, to close Tuesday at $36.85 per share after announcing its second quarter results.

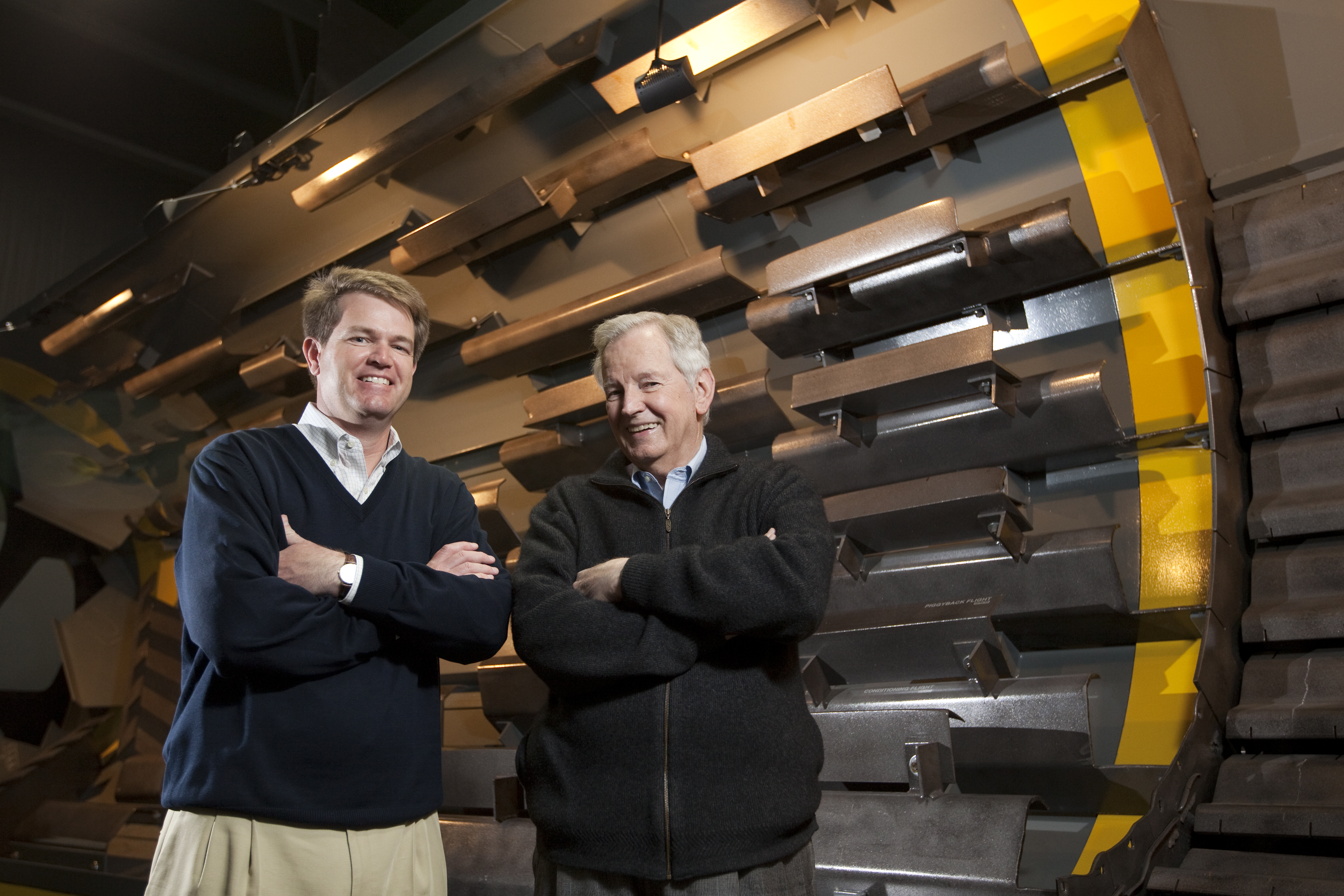

Astec CEO Dr. J. Don Brock blamed part of the slowdown this spring on rain delays for many paving projects that use Astec equipment and continued concerns about government budget cuts.

"We see our customers remaining very cautious due to the uncertainty coming out of Washington," Brock told analysts in a conference call. "Many customers on equipment are going from rent to rent instead of rent-to-own."

But Brock said the industry is picking up in the residential and commercial construction sector.

"With the delayed work for the first half of the year we expect to see their business much stronger in the second half," Brock said. "Hopefully this will improve demand during the fourth quarter and into next year."

Astec also expects future growth in its energy business with its new pellet plant, high tech drill rigs, pump trailers, water heaters and gas processing heaters. But Brock said the fall quarter may show a decline in that sector before a rebound in the fourth quarter.

"We were able to reduce our SG&A (selling, general and administrative expenses) compared to the first quarter of 2013 but our gross margin came in below our expectations in the Asphalt Group due to product mix and decreased overhead absorption," Brock said.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.