TVA's biggest backers fighting a proposed sale of the federal utility like the agency's power but not necessarily its financial standing.

Tennessee's U.S. senators claim the Tennessee Valley Authority is probably worth less than the debt it owes, which for most businesses would land them in bankruptcy court.

But TVA is no ordinary business.

As America's biggest government-owned utility created during the Great Depression by President Franklin Roosevelt, TVA is an independent federal corporation and enjoys at least the implied backing of Uncle Sam. Such government ownership and support, combined with TVA's ability to raise its customer rates at its own discretion, give TVA a top bond rating and the ability to borrow money for less than similar investor-owned utilities.

In his annual budget proposal last month, President Barack Obama proposed a strategic review of TVA that could lead to selling the U.S.-owned power company to cut the federal debt by at least $24 billion and "help put the nation on a sustainable fiscal path."

But Tennessee's U.S. senators insist that selling the 80-year-old New Deal agency wouldn't do much to cut the federal debt.

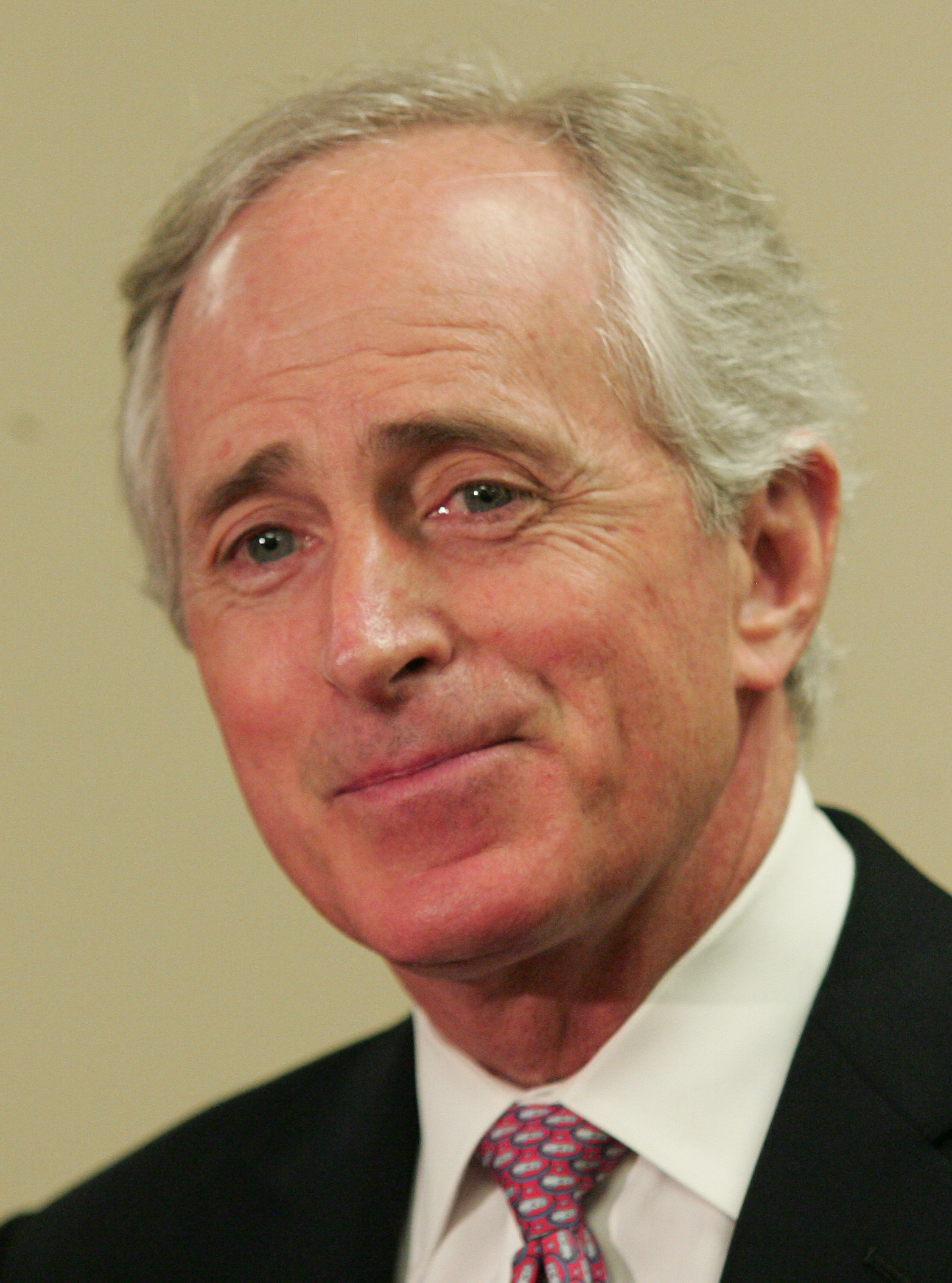

"While unfortunate but true, TVA as a going concern today is probably worth less than its debt and its rates have become increasingly less competitive, so if the goal is deficit reduction, I doubt this idea gains much traction," U.S. Sen. Bob Corker, R-Tenn., said.

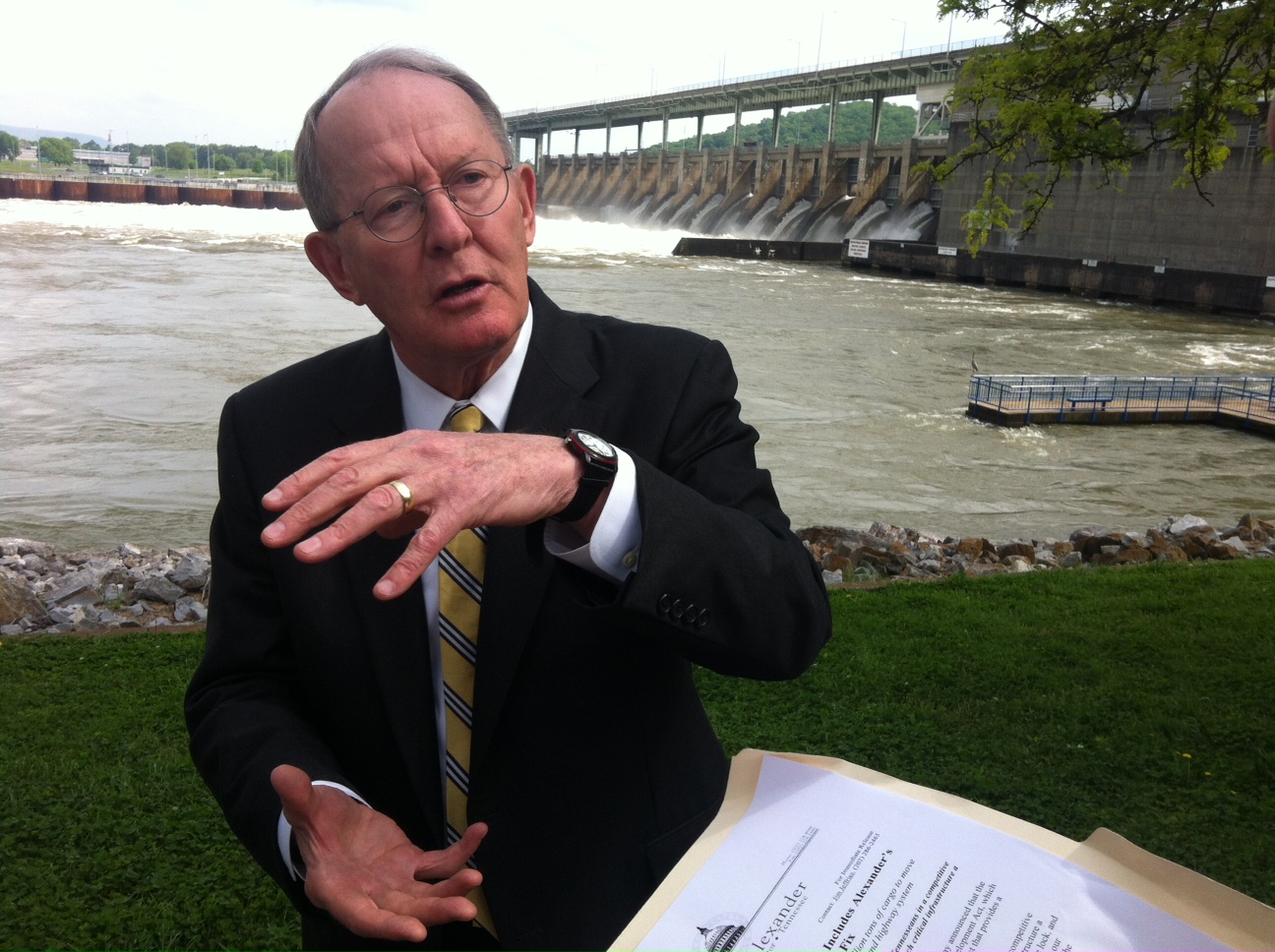

U.S. Sen. Lamar Alexander, R-Tenn., calls the budget proposal to privatize TVA "one more bad idea among many" in the president's budget.

"It will probably cost the federal government money to sell it, after you deduct the TVA debt, and it will probably raise electric rates in the Tennessee Valley, which is the last thing that we need," Alexander told reporters in Chattanooga this week.

TVA top officials insisted Friday the agency has true value -- both in what it does and in what its balance sheet shows.

TVA reported Friday that it earned $54 million on sales of $2.7 billion during the fiscal quarter ended March 31. In the same period a year ago, TVA lost $94 million on sales of under $2.6 billion.

TVA's new CEO, Bill Johnson, came to the federal utility from Progress Energy and Duke Energy in North Carolina. He said Friday there is a role for public power and TVA helps limit electricity prices in its seven-state service territory.

"We believe that the TVA model is a good one and the lowest cost model for carrying out TVA's mission," Johnson said.

TVA is meeting with OMB officials to help the administration conduct its strategic review of TVA, but Johnson said he is unsure of the schedule for any report or recommendations.

"We are a creation of the government and will work collaboratively and completely in that review," he said.

Johnson said the OMB study could help determine the market value and financial status of TVA. But he affirmed Friday the utility's balance sheet showing TVA has assets of nearly $47 billion, or nearly twice its statutory debt.

Credit rating agencies also reaffirmed their top bond rating for the Tennessee Valley Authority following meetings with TVA executives in New York last week. Nonetheless, Johnson said the OMB proposal to consider selling TVA could still raise borrowing costs for the federal utility later this year.

"The announcement has affected the spread on our bonds in the bond market, although there hasn't been a lot of activity with our bonds," he said. "The impact of all this should become apparent later in the year because we do have a significant amount of refinancing to do by the end of the fiscal year."

TVA Chief Financial Officer John Thomas said more than $2 billion of debt could be refinanced by TVA this fall at lower rates, but he said the uncertainty caused by the OMB proposal is likely to boost rates TVA will pay.

Alexander said talk about selling TVA has already raised TVA borrowing expenses.

"It would be much more responsible for the Obama administration to have private conversations with members of Congress about any financial concerns about TVA," Alexander said. "The only effect of this is to already raise the cost of borrowing more money for TVA and pushing up electricity rates."