WASHINGTON - Despite its easy passage in the Senate earlier this week, Sen. Lamar Alexander's top legislative priority is being slow-walked by House Republicans as he heads into re-election season.

To much fanfare Monday evening, Alexander's online sales tax legislation breezed through the Senate, 69-27. But the controversial bill must pass Congress's other half to reach President Barack Obama's desk.

The legislation's path hit turbulence Tuesday when House Speaker John Boehner, R-Ohio, joined a key House committee's top leaders to stonewall the bill for the foreseeable future.

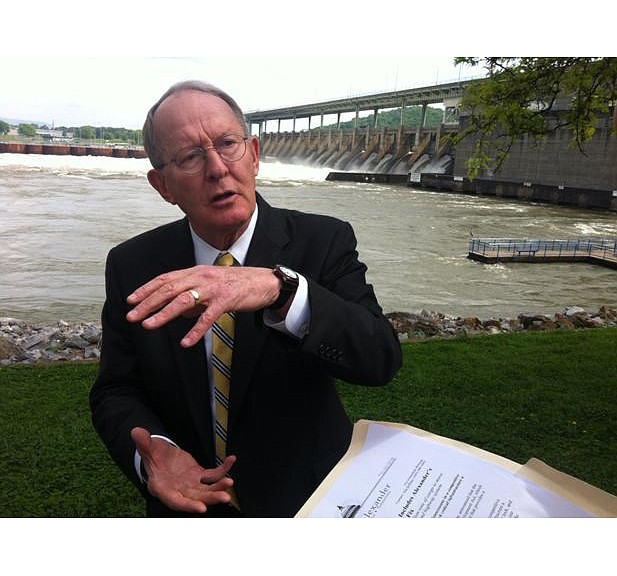

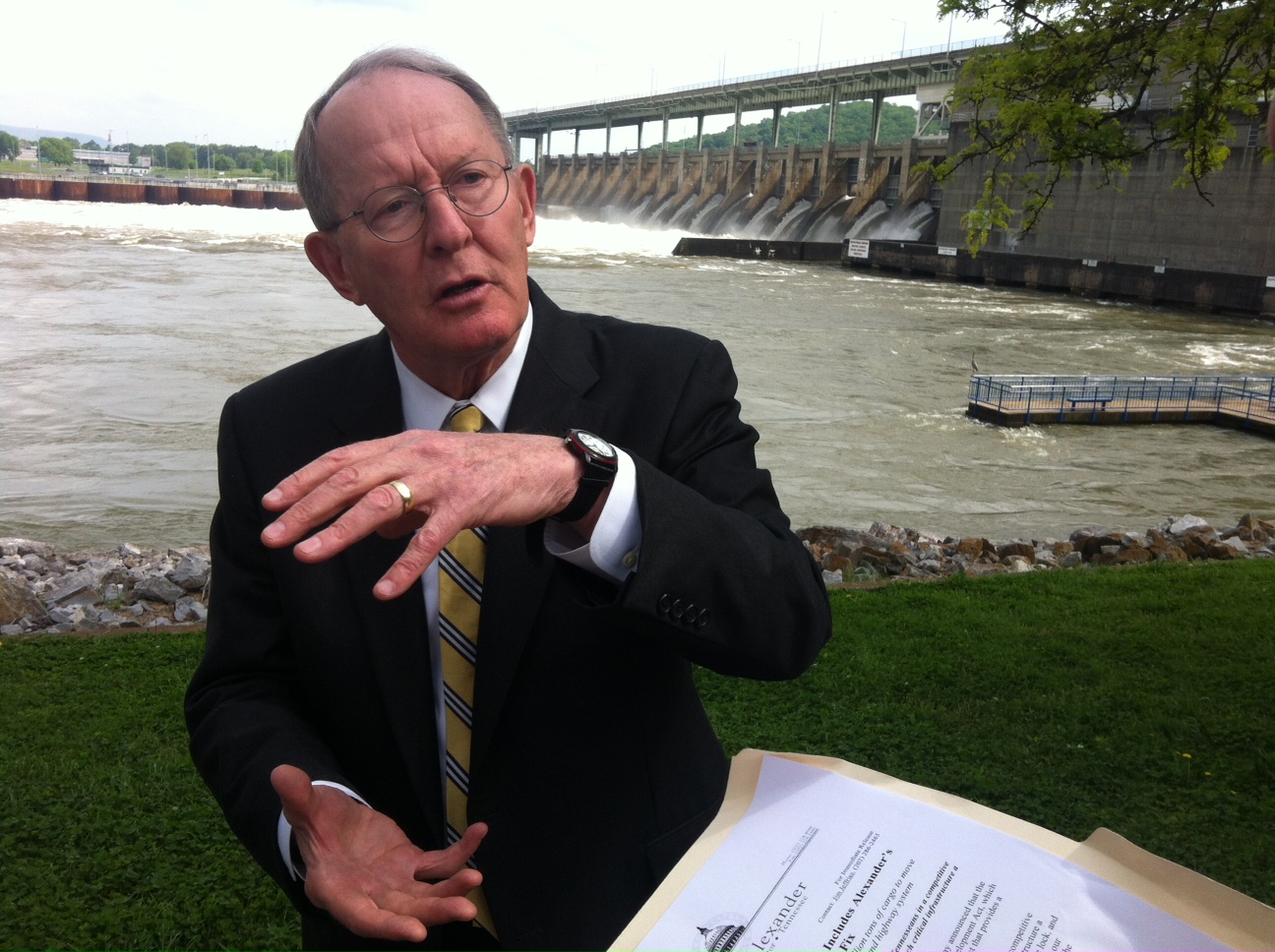

"I imagine it'll take weeks," Alexander said Wednesday. "I hope they do it this year."

House conservatives see the bill as touchy because they consider it a new tax, but Alexander and other proponents insist it only allows states to collect tax already owed.

The Marketplace Fairness Act would give states the authority to compel online retailers with more than $1 million in annual sales to collect sales taxes on all transactions and remit the proceeds to state and local governments. Participating states would have to provide free software to help calculate America's many tax rates.

Current law requires consumers to self-report sales taxes on Internet purchases, but almost no one does. Governments largely don't punish offenders, and many House leaders enjoy that status quo.

Asked Tuesday whether he could support the bill, Boehner said, "probably not."

"I just think that moving this bill where you have 50 different sales tax codes -- it is a mess out there," Boehner told Bloomberg Television. "You are going to make it much more difficult for online businesses to be able to comply with it."

STALLED iN COMMITTEE

All eyes are on the House, where the bill must clear the Judiciary Committee before reaching the floor. Boehner indicated he wasn't pressuring committee leaders to rush the bill, and Chairman Bob Goodlatte, R-Va., appears to be in no hurry himself. No hearings have been scheduled.

In a statement released minutes after the Senate approved the bill, Goodlatte complained of potential burdens on small online businesses, citing "hundreds of tax rates and a host of different tax codes and definitions" to decipher.

"I am open to considering legislation concerning this topic," he said, "but these issues, along with others, would certainly have to be addressed."

Alexander and other proponents have said free software will alleviate the tax math. But the No. 2 Republican on Judiciary, U.S. Rep. Jim Sensenbrenner, R-Wis., slammed taxes broadly, saying the bill would create "a chilling effect on online commerce."

In an odd twist, some of the bill's staunchest opponents are Tennesseans who have signed up to help Alexander's re-election effort. The most high-profile is U.S. Rep. Marsha Blackburn, a Brentwood Republican.

"The American people have been taxed enough," she recently said.

Up for re-election next year, Alexander acknowledged it could take a while before he convinces House conservatives to reject "discrimination against Main Street sellers" already required to collect cash-register sales tax.

"I'm not so surprised," the former Tennessee governor said of House GOP skepticism. "It sounds like a tax bill, but in fact, it's a bill to allow states to collect a tax that's already owed."

HASLAM INTERVENES

A year after offering supportive testimony on Capitol Hill, Gov. Bill Haslam has re-entered the online sales tax debate. He said he plans to win over the Tennessee delegation, reluctant Republicans included.

Speaking to reporters at an independent Nashville bookstore Tuesday, Haslam said Alexander's bill represents a boon for Tennessee, which he described as a "sales tax-driven state."

"We have folks -- this bookstore -- that are providing a product and collecting sales tax and other folks who are providing the same product and not collecting sales tax," Haslam said, according to audio provided by the governor's office. "And it's not a new tax."

Alexander speculated what Haslam's next move might be if the bill passes.

"I think what they'll do is use the extra revenue to lower the tax rate," Alexander said. "That would be good for Chattanooga."

Contact staff writer Chris Carroll at ccarroll@times freepress.com or 423-280-2025.