Audit chides Tennessee over job tax credits

Wednesday, November 13, 2013

NASHVILLE - Tennessee's tax collectors are not adequately documenting that growing businesses getting tax breaks from the state are generating the jobs they promise, a state audit suggests.

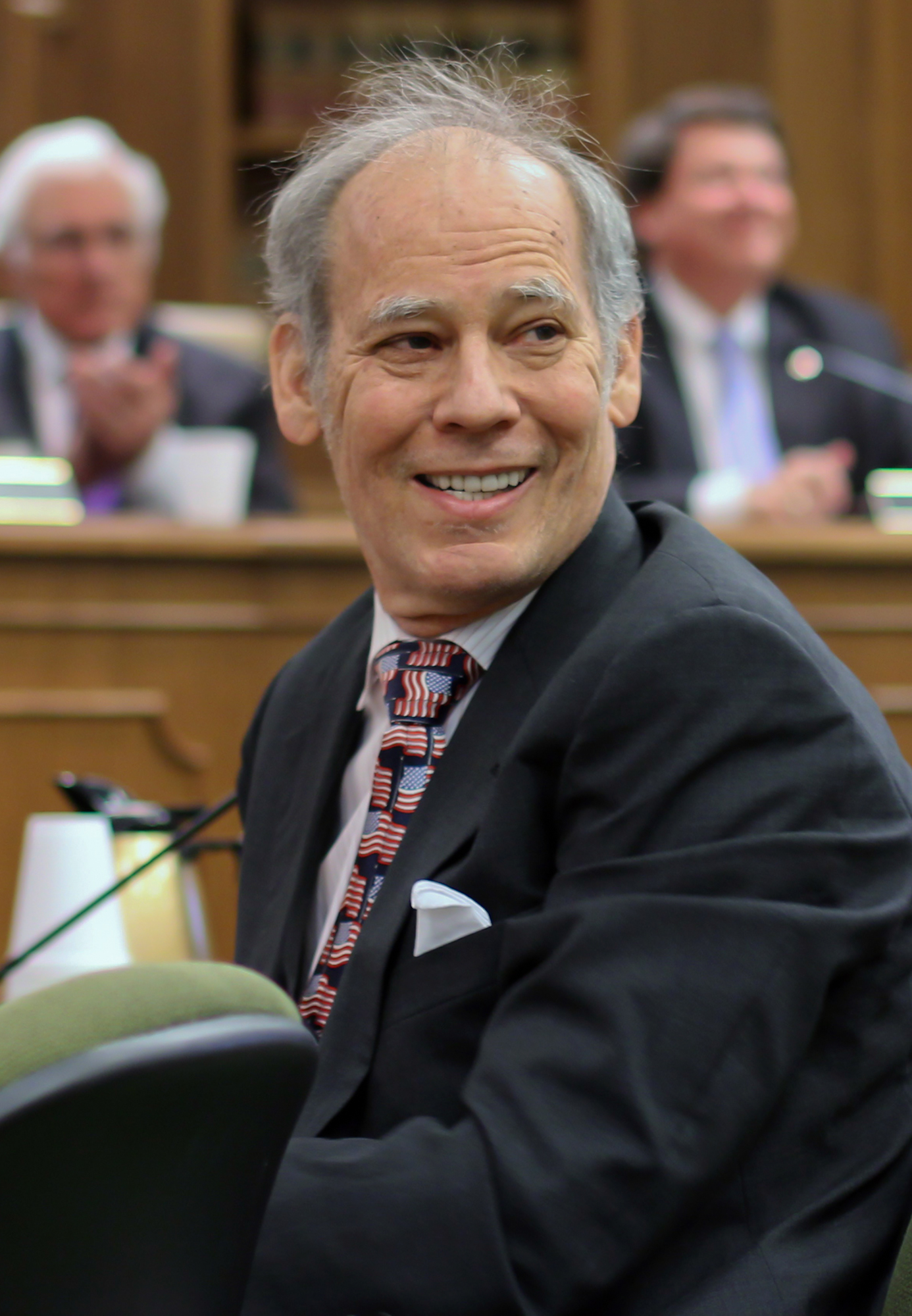

Tennessee Comptroller Justin Wilson said the state's jobs tax credit program may not have been implemented as intended.

"The Department of Revenue's management did not adequately document that tax audits related to the jobs tax credits and ultimately could not provide evidence that companies audited complied with state law," the Comptroller said in a 48-page audit released Tuesday.

Tennessee offers new or expanding businesses job tax credits of up to $4,500 for each new job created for up to 15 years, but the tax break depends upon the state verifying that the business invests at least $500,000 in the facility and add at least 25 full-time jobs. Such credits have been a key part of incentive packages used to lure new investments such as the $1 billion Volkswagen plant announced in Chattanooga in 2008 and the $2 billion Wacker Chemical plant announced in Charleston, Tenn., a year later.

Michael Edwards, audit manager, testified on Tuesday before a joint meeting of a joint House and Senate Government Operations subcommittee that a "lack of a detailed audit program contributed to inconsistency among revenue tax auditors and supervisors when documenting and reviewing the tax audits."

Unless an auditor "clearly documented the evidence they reviewed, others who were not directly involved in the audits could determine that evidence actually met the statutory requirements."

Revenue Commissioner Richard Roberts told the panel "without question we should have documented things to a better and more complete degree."

But the commissioner said said overseeing the Jobs Tax Credits program "is almost as complex as the credit itself." The law has changed almost annually over the past 10 years "adding multiple levels of tiers and credits and categories of eligiblity," Roberts said.

A priority of the department has been to confirm that the initial business plan submitted by companies applying for credits are" reviewed consistent with the changes in the law and applied consistently across taxpayers," he said.

But Roberts emphasized "that the various weaknesses listed in the report do not alter the fact that the department correctly approves jobs tax credits qualifications and consistently holds taxpayers accountable for meeting those qualifications."

Senate Government Operations Committee chairman Mike Bell characterized the issue as "boo keeping" and asked Edwards, the comptroller auditor, if he found "any evidence that tax credits were paid where they should not have been paid."

Edwards said "in my mind it goes beyond record keeping. As an auditor, the basis for the audit's conclusions that we have is the evidence that it's in our work papers. It is absolutely essential that whatever conclusions you come up with whenever you're doing an audit you're making a conclusion ... whether the person who qualified for the jobs tax credit or did not.

"When we were looking through their audits, potentially you couldn't determine totally where the numbers came from," Edwards said. "We're not saying the audit was not done correctly. What we're saying is that an indepenent third party could not determine where the evidence to support the conclusions in the audit came from.

But in response to another question from Bell, Edwards said, "we could not determine whether credits were given incorrectly and we do not say that in the audit."

Roberts called the comptroller's audit "instructive" and "humbling."

Gov. Bill Haslam told reporters he "hasn't seen those audits" and couldn't comment specifically on the findings. But he said his understanding is "we've actually done a better job of going back and auditing those."

Moreover, Haslam said, a change in state law now includes "claw back" provisions on grants to companies "where we have the right to go back in and pull that money back, which we hadn't been doing those before."

Contact Andy Sher at asher@timesfreepress.com or at 615-255-0550.