Two days before Thanksgiving, homeowner Bob Smith faced eviction from his St. Elmo house.

The bank had changed the locks on the doors weeks earlier. Some of Smith's possessions were still inside. Hamilton County police officers would arrive Tuesday morning to remove him from the property, he was told.

The night before the eviction, a group of neighbors and supporters, including members of Occupy Chattanooga, grilled burgers on Smith's front porch to celebrate his last day at the house and raise awareness about foreclosures that they say are hurting communities like Chattanooga.

But before their food was fully digested, city police arrived, the group says, after Facebook posts about the BBQ alerted officials to the gathering.

"They were nice, but they said we had to leave," said Brian Merritt, a pastor and member of the Occupy movement.

Smith, who works in flooring and home improvement, ran into financial trouble when a gall stone left him in the hospital for eight days, a medical emergency that occurred shortly after a large renovation job didn't pay out. He couldn't settle things with the bank, and is now facing the lost of his biggest asset.

It's a story many former homeowners know well. Risky loans made during the housing bubble strained homeowners' ability to repay and left many without a place to live. Banks themselves, pushed by regulators and investors to shore up questionable lending portfolios, rushed to sell depressed properties for a loss, desperate to improve the health of their balance sheet.

But homeowners with troubled loans in Chattanooga, a city that represents 10 percent of all foreclosures statewide, have another option besides going toe-to-toe with eviction officials. For a few more months, anyway.

The state's Hardest Hit Fund, which is funded by the 2008 Troubled Asset Relief Program, or TARP, is scheduled to expire early in 2014. Until it does, officials at Chattanooga Neighborhood Enterprise said they are doing all they can to tell homeowners about tens of thousands of dollars of assistance available to them at no cost.

"They're expecting that they'll run out of funds sometime in the first quarter of 2014," said Martina Guilfoil, new executive director of CNE, which offers foreclosure prevention assistance in the Chattanooga area and surrounding counties. "If you're experiencing any hardship, come see us now."

State officials have expanded the program over the last few years in an effort to widen its reach and finish spending what was initially supposed to be "stimulus" money, injected into the economy quickly to counteract what became the Great Recession. Today, CNE's foreclosure prevention program offers qualifying homeowners up to $40,000 in mortgage payments over three years.

To qualify, a homeowner must experience a hardship -- unemployment, reduction in income, divorce, death of a spouse, or disability -- that threatens their ability to stay current on their mortgage, and must demonstrate a financial need for assistance.

That's it. Other than a mound of paperwork and a few meetings, there are few other qualifications for the program, which has helped people like Bufford Kilgore stay in their home. Kilgore's home was days away from being sold on the courthouse steps when he found out about the CNE fund.

"They were getting ready to sell it," Kilgore said. "CNE put a stop to it."

He's disabled because of back and respiratory issues, and collects about $1,000 per month from the government with which to pay all his bills. As his monthly payments to the bank ballooned from about $400 up to more than $600, he started to fall behind.

"I would have been in my van, me and my wife," he said.

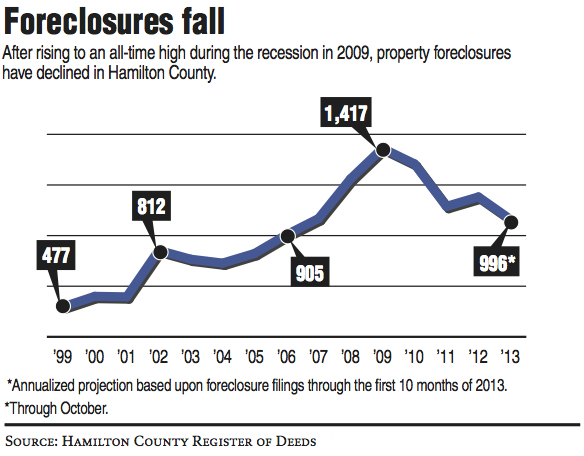

Though there's no shortage of underwater homeowners, the total number of foreclosures has continued to plummet from the highs during the housing crisis. Foreclosures in Hamilton County peaked at 1,417 in 2009, but have fallen to fewer than 1,000 in October.

Nationwide, foreclosures rose 2 percent in October, though they're down 34 percent from the same month in 2012, reported research firm RealtyTrac. Increasing property values mean that banks are more likely to pursue foreclosure sales -- hoping to get something approaching the appraised value of the home -- rather than short sales, which many financial institutions favored during the height of the recession.

But while the number of foreclosures has continued to fall, it's still too high for Guilfoil. To her, those numbers mean that many homeowners continue to slip through the cracks, going into foreclosure rather than contacting CNE to preserve their home.

Whether it's an unwillingness to seek assistance due to the stigma associated with financial trouble, or just a general wariness about foreclosure prevention scams, she's hoping that homeowners will drop their inhibitions and reach out for help.

"I understand that 10 years ago, the idea of foreclosure was like wearing a big scarlet 'A' on your chest, but nowadays, it happened to so many people, I just don't think it has the stigma that is used to have," she said. "You kind of suffer by yourself with this stuff sometimes, but with this program you can come in and say, 'Gee, it's a roomful of people who are going through the same thing that I am. It's therapeutic."

Contact Ellis Smith at 423-757-6315 or esmith@timesfreepress.com.