NUMBERS OF PHARMACIES BY STATETennessee555 - independent pharmacies418 - chain pharmacies222 - supermarket pharmacies244 - mass merchant pharmaciesGeorgia734 - independent pharmacies741 - chain pharmacies437 - supermarket pharmacies248 - mass merchant pharmaciesSource: National Community Pharmacists Association

Kingwood Pharmacy in East Ridge is always packed during the first weekend in November because that's when the 69-year-old pharmacy holds its annual Christmas open house. It's festive -- new products, refreshments and discounts abound.

"It's more like a homecoming," said store manager Joe Harper. "Customers who haven't been in but once or twice a year come in. Everyone comes back for the open house."

Some customers bring their out-of-town kids, just to say hello and chat with the pharmacy's 34 staff members.

"We tell our customers how much we appreciate them," Harper said. "Because they do pass several pharmacies coming here."

The fact that loyal customers pour in every year without fail is one reason why Harper and other area independent pharmacists aren't worried about competition from national chains. Independent pharmacists are confident that chains can't offer the same personal care and service that an independent can. There's still a market, they say, for the individual pharmacy store.

But in a world increasingly driven by convenience, insurance and low prices, independent pharmacies are facing a tougher market than ever. The number of independent pharmacies in the United States has been halved in the past three decades, and several high profile pharmacies have recently closed or sold in the Chattanooga area, including the 84-year-old Belvoir Pharmacy and 120-year-old Chickamauga Drug Store.

"It hurts me," said Jerry Grimmitt, who's owned 58-year-old Longley Pharmacy in Rossville since 2001. "I hate when anyone sells out. I'll compete with Walgreens and CVS all day long. They don't scare me. I know that once someone comes in here once or twice, they're going to come back. So we compete, but our real competition is the PBMs."

PBMs, Prescription Benefit Managers, are the middlemen between insurers and patients. The multi-billion dollar companies set reimbursement rates, establish insurers' accepted pharmacy networks and decide which drugs are preferred and which aren't. The companies collectively handle prescription drug benefits for more than 216 million Americans, according to the Pharmaceutical Care Management Association.

When a pharmacy sells a drug, nine times out of 10, it's a PBM that reimburses the pharmacist. And lately, those reimbursement rates have dropped to barely livable reimbursements, local independent pharmacists say.

"Every day we'll lose money on some prescriptions," said Mason Ledford, owner of Ledford RX Express Pharmacy in Lafayette, Ga. "It's difficult. Because you want to provide good care, everything the patient needs, but then you'll get reimbursed so low, at a rate you can't hardly afford. There's a lot of soul searching that has to go on."

Some pharmacists are stuck in a catch-22. They're barely breaking even on the reimbursement rates offered by PBMs, but because the PBMs dominate the market so completely, the pharmacists can't afford not to do business with them.

"You have no option," Grimmitt said. "Nationally, 90 percent of prescriptions are covered by PBMs. If I didn't do business with them, I'd be doing 10 percent of the volume I'm doing now."

Consumers will go to pharmacies that accept their insurance, and if you're not in the network, you're out of luck, said Brad Standefer, owner of four local independent pharmacies, including Access Family Pharmacy in Hixson.

"If you go to Target and your prescription is free, but you go anywhere else and it's $20, you're going to go to Target," Standefer said. "You can't compete with that."

But the Pharmaceutical Care Managment Association, which represents PBMs, say PBMs will save consumers and insurance providers an estimated $2 trillion in prescription drug costs between 2012 and 2021. That's a 35 percent drop.

"There are 70,000 pharmacies that find it in their best interest to work with us," said David Whitrap, director of communications at Express Scripts, the nation's largest PBM, with $94 billion in revenue in 2012. "And our primary goal is to make these prescriptions drugs safer and more affordable for patients and employers. Everything we do falls under that mission. If there is excess expenditure, it's our duty to look at that and evaluate that."

Retail pharmacies offer discounts on drugs in order to be included in PBMs' networks, according to the Pharmaceutical Care Management Association. And on the production side, drug manufacturers offer rebates in order to be named a 'preferred' drug by the PBM, which then means the PBM gives the preferred drug a lower copay than competing drugs.

It's a model based on volume. And the problem, Standefer and others said, is two-fold: independent pharmacists have no leverage to negotiate higher reimbursement rates with the major PBMs, and often independent pharmacists are left out of PBMs preferred networks. The larger pharmacy chains have more power at the negotiating table.

"[PBMs] set the rules, and they squeeze independent pharmacy owners," said John Norton, director of public relations at the National Community Pharmacists Association. "They make their life very difficult because they offer take or leave contracts."

But Whitrap said independent pharmacies are a vital part of Express Scripts business, in part, because the PBM wants to ensure consumers have easy access to in-network pharmacies, even in rural or underserved areas.

"We sit down with pharmacies and negotiate," he said. "And generally we meet in the middle. If we can't come to an agreement, then they're not in our network. We don't prioritize national chains over independents by any means."

BRAVE NEW WORLD

At Kingwood Pharmacy in East Ridge, the shelves are filled with Vera Bradley bags, Hallmark products, daily necessities and unusual gifts. The store issues hunting and fishing licenses, and store manager Joe Harper doubles as a notary.

"We're not just aspirin and prescriptions," Harper said. "We've diversified quite a bit."

That's been key for independent pharmacists, Norton said. While the number of independent pharmacists was slashed in half by the mid-1990s, the numbers nationwide have steadied during the last decade, stabilizing at about 23,000 -- give or take a few hundred every year.

As Baby Boomers get older and the Affordable Care Act pushes more patients into the healthcare system, independent pharmacists have found a niche providing personalized care, and offering extras like vaccines, prescription delivery, lifestyle classes or dietary and exercise plans.

"If the playing field was a little more level, you'd really see independent pharmacists take off," Norton said.

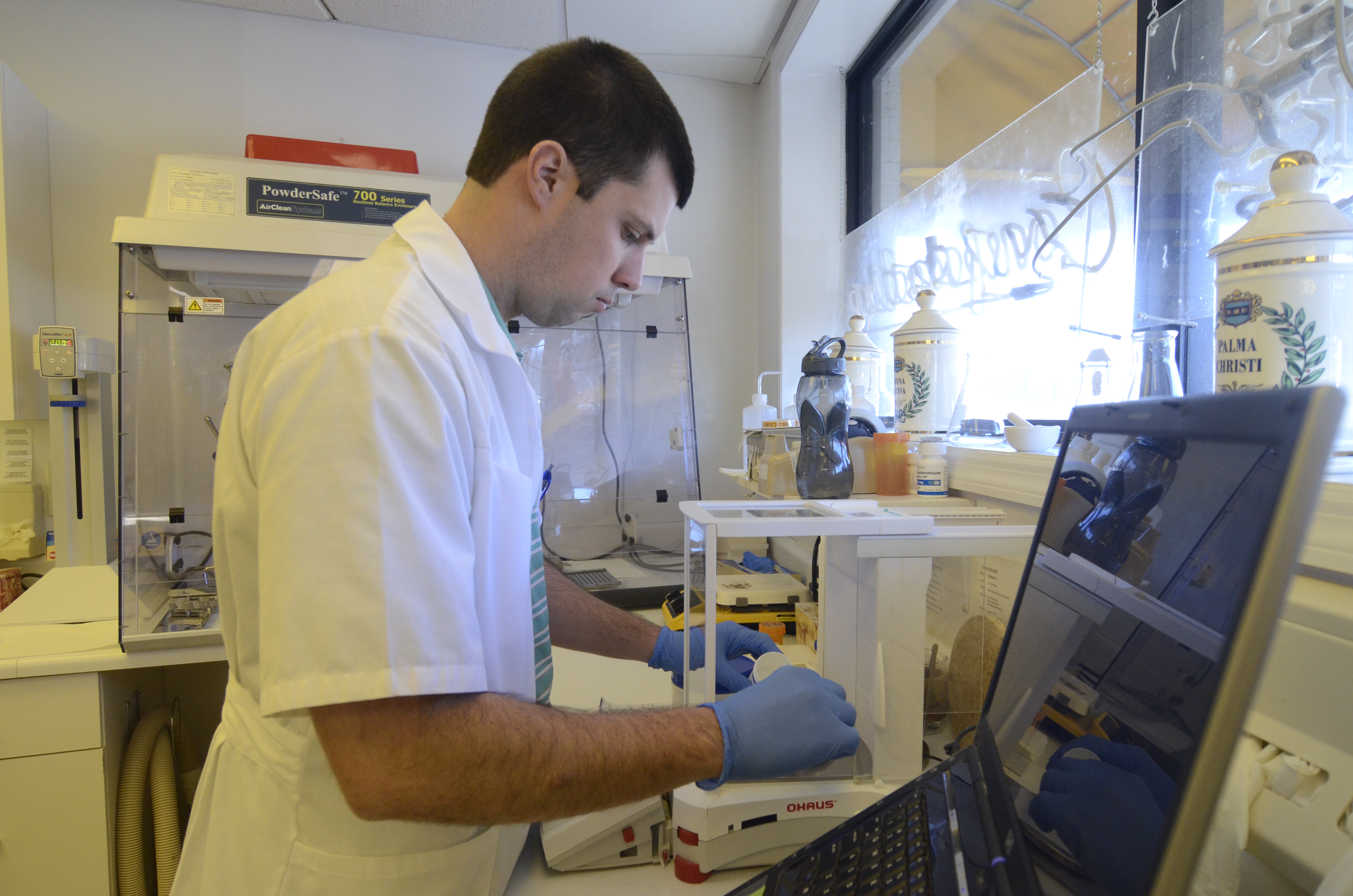

At Standefer's pharmacies, his 50 employees offer medication therapy management, medicine compounding and specialty packaging for assisted living facilities to generate extra revenue.

"Everything is something, nothing is a big home run," Standefer said."You can do $8 million in sales and still go out of business."

And that's why some pharmacists decide to sell. Most independents have been approached at some time or another by a chain looking to buy the store. In LaFayette, Ledford used to own two pharmacies -- with a second location in nearby Summerville, Ga., but he sold the Summerville pharmacy in order to focus on the LaFayette store.

"It was a shame," he said. "I really hated it. But I can't be in both places. Don't want to get too many eggs in one basket."

He worked in chain pharmacies for years before he founded his own, and said he's glad he made the switch, despite the initial pay cut.

"I love independent pharmacy," he said. "That's why I'm here. You get to talk to people. And every now and then you get a case where can really help someone out."

He hopes he'll be able to keep the 9-year-old pharmacy running for years to come.

"I have a lot faith, I don't know why, in our system," he said with a laugh. "I think someone is going to realize you can't ruin people who have worked their whole lives to build a business and provide the care and the money-saving, life-saving opportunities we do. I keep thinking they're going to help us out. Give us a fee we can live with."

Standefer, whose pharmacies started as long ago as 1947, said he's never thought about selling.

"I've got patients that depend on me," he said. "And I don't want anyone else to care for them but us."

He laughs when asked what he's doing to stay competitive.

"We're doing everything we can," Standefer said. "We're doing everything. Will that be enough? Time can tell."

Contact staff writer Shelly Bradbury at 423-757-6525 or sbradbury@timesfreepress.com.