A suddenly stormy month on the stock market came to a quiet end on Tuesday.

Major indexes drifted to a slight loss Tuesday and during Sepetember, but those losses were not enough to offset gains in the major exchanges during the third quarter of 2014.

For the three months ended Tuesday, the Dow Jones Industrial rose 1.3 percent, the S&P 500 gained 0.6 percent, and the Nasdaq climbed 1.9 percent.

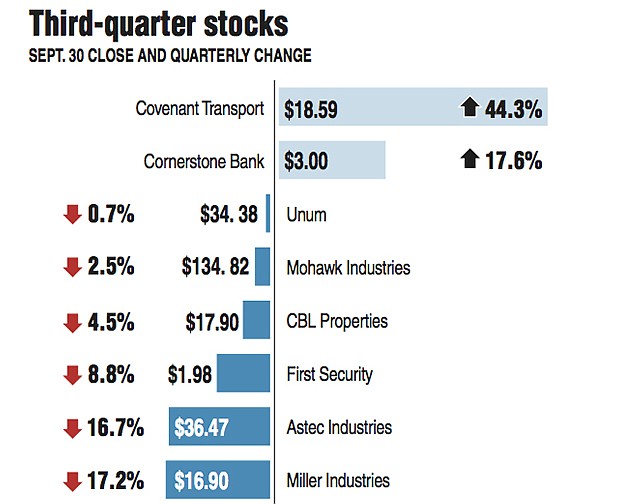

But most of Chattanooga's publicly traded companies didn't fare as well in the quarter. Despite major gains in the past three months in the share prices for Covenant Transport and Cornerstone Bank and the seven other stock-traded companies in the region all showed a decline in stock prices during the third quarter. After strong gains last year and in the first half of 2014, stock values have eased for many companies as earnings growth has not kept up with the rise in share prices.

The housing market appears to have taken a pause in its recovery, holding down share prices for carpet makers like Mohawk Industries and the Dixie Group. The future of road building also remains muddled by congressional inaction on a long-term highway bill, hurting the value of Astec Industries. Retail sales showed gains this summer, but not enough to offset concerns over the retail shift away from many traditonal shopping centers, which hurt the value of CBL Properties and other Real Estate Investment Trusts this summer.

The S&P 500, the main benchmark for mutual funds, reached a record high on Sept. 18, supported by news of stronger economic growth in the U.S and reassuring words from Federal Reserve officials about keeping interest rates low. But turbulence hit the following week as investors began questioning whether the stock market was overpriced. Some warned that the market had been calm for too long.

"It's like when warm currents and cold currents converge, you get a lot of waves and turbulence," said Jack Ablin, chief investment officer at BMO Private Bank. "We're now at a point where we have sharply different opinions in the market. It's a tug of war."

Trading has turned choppy over recent weeks. Lingering concerns over conflicts around the world, corporate profits and the strength of the global economy have all played a role, said Robert Pavlik, chief market strategist at Banyan Partners. Investors are also wary of the fact that some of the market's worst swoons have happened in the months of September and October.

"People are unsure at this time of the year," Pavlik said. "We're heading into October. Like September, it's another typically bad month for the market."

Analysts also are skeptical of how many more gains are in store for the market this year, with the S&P 500 up 6.7 percent since Dec. 31 and third-quarter earnings still ahead.

"The market continues to be very resilient, but it's a monster market. I think you could have a weaker fourth quarter than you've gotten used to, and I think we've made our highs for the year already," said Uri Landesman, president at Platinum Partners in New York.