Profits for paving equipment maker Astec Industries hit a rough spot in the third quarter, falling 71 percent from year-ago levels and dropping to only a fraction of what analysts had forecast for the summer period.

Despite an improved private paving market, Astec said Tuesday its third quarter income was battered by congressional inaction on both a long-term highway spending package and an R&D tax credit extension.

Astec earned $1.9 million, or 8 cents per share, on sales of $220.2 million in the third quarter. A year ago in the same period, Astec earned $6.5 million, or 28 cents per share, on sales of $213.2 million. Analysts had projected the company would earn somewhere between 34 cents and 52 cents per quarter in the current quarter.

Todd Vencil, an analyst for Sterne Agee, said Astec margins were below expectations in all of its major industry groups and Astec was unable to recognize revenue from its new $60 million wood pellet plant because of terms of Astec's finance arrangement with a customer. Vencil said Astec's backlog was up 28 percent over a year ago and "this may well augur better results going forward."

Nonetheless, shares of Astec fell Tuesday by 25 cents per share to close at $36.69.

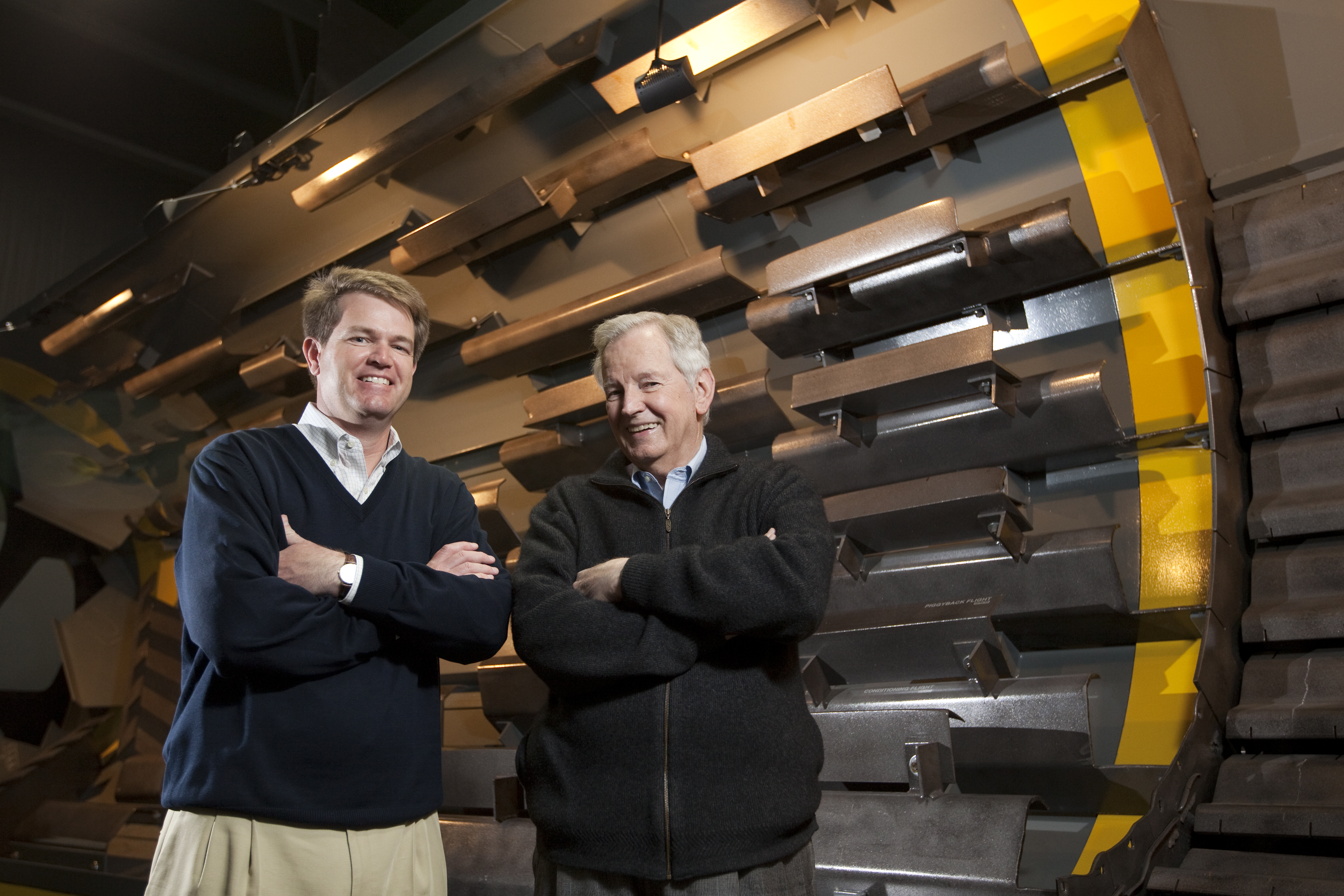

Astec CEO Ben Brock told analysts he was disappointed in the results, although he said he expects a better fourth quarter with the company's backlog up.

"Our Energy and our Aggregate and Mining Groups performed OK while our Infrastructure Group lagged due primarily to the lack of a federal highway bill, pricing pressure as a result, and product mix," Brock said in a statement. "A 64 percent tax rate for the quarter was another challenge to our earnings in the quarter."

The tax rate for Astec nearly doubled from a year ago because of the lack of R&D credits the company was able to claim a year ago and differing foreign earnings results this year that couldn't be utilized to offset taxable income in the U.S.

Nonetheless, Brock said the outlook is improving for Astec with a growing backlog, improved parts sales and expected cost improvements from lean manufacturing initiatives.

"The encouraging news for us, though, is that for the first time in about five years, we are hearing from our infrastructure customers that they are having a good year and do have backlogs of work to do particularly on the private side," he said. "And that's pretty exciting for our business.

Domestic sales increased for Astec in the quarter by 8 percent from a year ago to $142.6 million. International sales decreased 4 percent to $77.6 million this summer compared with a year ago.

Contact Dave Flessner at dflessner@timesfreepress.com or at 757-6340.