If you are a current beneficiary of Social Security, there is good news. You're getting a raise. If you're also a participant in Medicare, odds are high that you won't get to keep it.

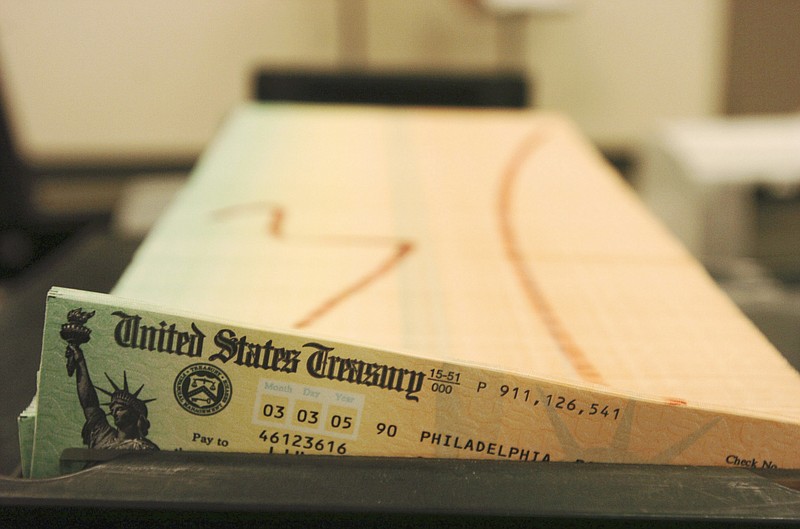

First the good news. Uncle Sam makes annual adjustments to Social Security payments designed to keep up with changes in the cost of living. Beginning in January of 2018, recipients will receive an additional 2 percent in each check to account for current price inflation. The increase in the income benefit is based upon the familiar consumer price index or CPI, which is computed each month by the Bureau of Labor Statistics. When most people talk about inflation, they generally mean the annualized change in the CPI, and most benefit programs that adjust cash flows for inflation are pegged to this ubiquitous index.

The original "old age insurance" program signed into law in 1935 did not include automatic indexing. Beneficiaries were dependent upon lawmakers to step in periodically to adjust income payments to keep up with the cost of living. In 1975, Congress passed legislation tying Social Security payments to the CPI and mandating annual cost of living adjustments (COLAs) based upon prices in the third quarter of the year compared to same quarter a year earlier. This year it's 2 percent, compared with just 0.3 percent last year an no increase at all for 2016 (note that benefits cannot decline even if inflation is negative in any given year). The biggest automatic increment was a 14.3 percent hike in 1980 during the greatest inflationary period in the modern era.

Taking the average of all recipients, the 2 percent raise translates into about $25 per month bringing the average payment to $1,283.

Now for the bad news. Don't get too attached to it. About three-quarters of Medicare participants will see their premiums increase by the exact same amount. Easy come, easy go.

Actually, most Medicare subscribers benefit from a provision that limits the impact of premium increases in the government medical care program. Medicare charges premiums for its part B coverage (which includes outpatient care, doctor visits and certain medically necessary equipment and treatments). Most seniors pay their part B premiums via deduction from their Social Security income payments.

It is hardly surprising that medical costs have traditionally increased at a faster pace than the CPI and therefore faster than Social Security COLAs. In order to limit the impact on beneficiaries, annual increases in Medicare part B outlays can be no more than the COLA. As a result, the current part B monthly premium is $134, but most recipients pay only $109 on average because of the hold-harmless limits and the relatively low annual COLAs over the past decade of low CPI inflation.

New enrollees in the Medicare program do not benefit from the part B inflation limits and will be subject to the full annual increases going forward.

All this means that most Social Security beneficiaries whose part B premiums are deducted from their monthly benefit will see their raise diverted to Medicare instead. So on the one hand, no change in income payments, but on the other hand, Medicare premiums are not allowed to increase at the current real rate of health care inflation. Still a pretty good tradeoff if you think about it. And don't forget that a retiree's mortal enemy is high inflation. In the end, we should be glad our raise isn't comparable to the one in 1980.

Christopher A. Hopkins, CFA, is a vice president and portfolio manager for Barnett & Co. in Chattanooga.