WASHINGTON - What's due but not collected will soon be taken up if the U.S. Senate has its way.

Heavy on appeals for equal treatment, the Senate on Monday advanced a bill that would allow states to require online retailers to collect sales tax on every transaction -- something their brick-and-mortar rivals already do.

As the Senate voted 74-to-20 Monday to bypass committee work and begin floor debate on the Marketplace Fairness Act, lawmakers said the conflict helps define a 21st century driven by online growth. Insiders predicted a weeklong fight over what the Financial Times called "the most incendiary political issue in retail."

Since the advent of the Internet, consumers have been able to browse brick-and-mortar stores and get information on models, cost and efficiency. In a bygone era, several senators remembered, the cash register was the next logical stop. Nowadays, they lamented, customers abandon physical retailers and head straight home for their computers.

Unlike what happens at cash registers, current law requires Internet users to report online purchases, calculate in-state sales tax and pay it themselves. But virtually no one pays, and authorities hardly enforce the law. Tennessee Gov. Bill Haslam has said the dodgers deprive the Volunteer State of $400 million annually.

The Marketplace Fairness Act would allow state governments the option to require out-of-state retailers to collect sales tax on businesses making more than $1 million in annual revenue.

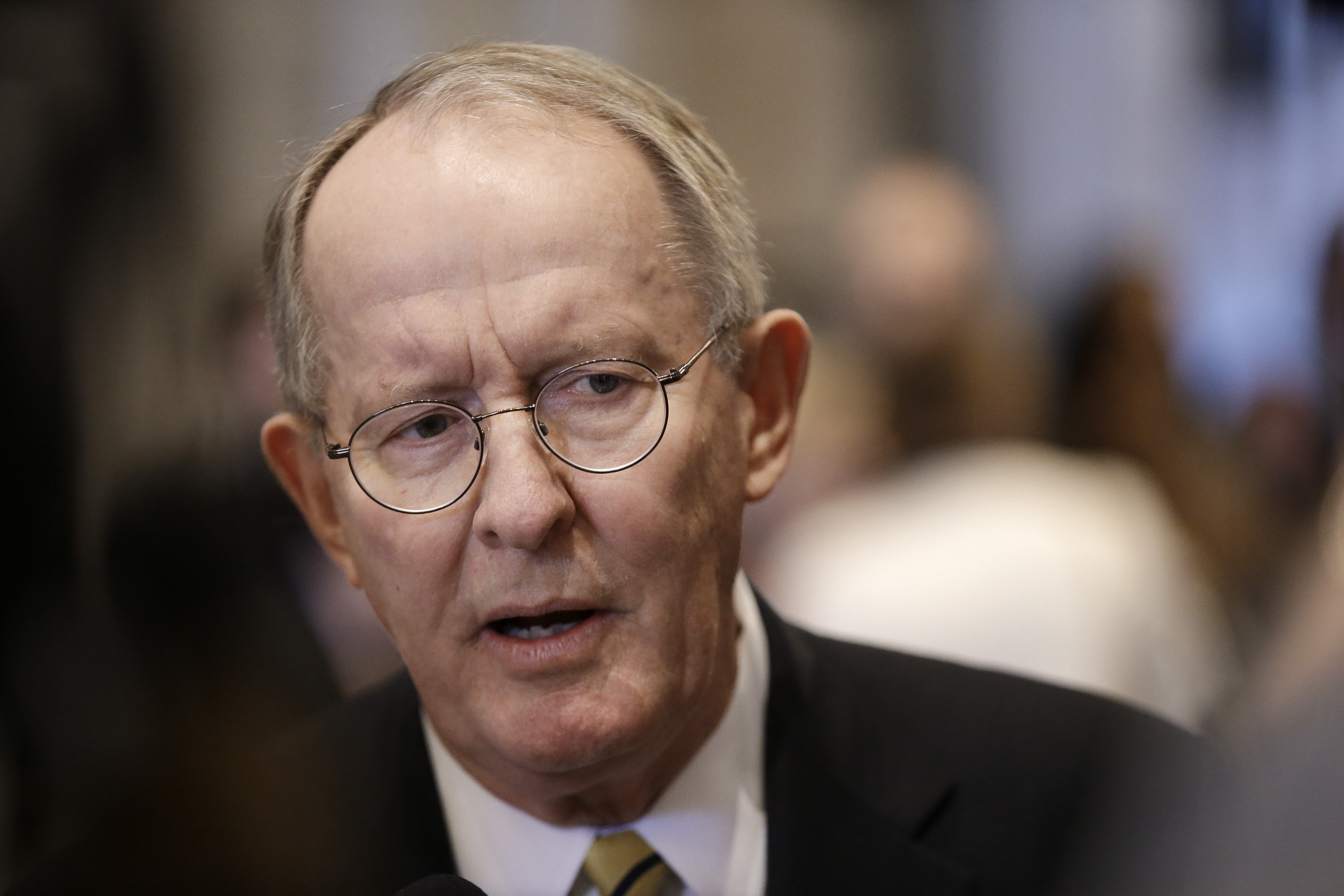

U.S. Sen. Lamar Alexander, R-Tenn., has long sponsored and pushed the bill, which is supported by online titan and Chattanooga employer Amazon.

Opponents have been vocal, with lawmakers and large companies citing a bureaucratic mess to come. The online auction hub eBay said the bill represents "a new tax barrier in front of small businesses," and others have said the legislation would overwhelm businesses with unnecessary regulation.

"The requirement to calculate sales-tax rates, much less collect those taxes, for each customer becomes even more burdensome when considering the various state, city and county sales taxes that will be imposed across the United States," Sen. Rand Paul, R-Ky., wrote in the Washington Times last week.

Supporter and Sen. Sheldon Whitehouse, D-R.I., said new software technology would aid business owners toward "a virtually seamless transaction."

The debate put Republicans in the strange position of endorsing the ability for states to engage in nationwide tax collection. Monday's arguments also inspired Democrats into using conservative talking points to express their opposition to the bill.

Senate Finance Committee Chairman Max Baucus, D-Mont., lamented the idea of businesses having to lay off workers and hire "expensive lawyers and accountants" to keep track of tax codes.

"How does this grow our economy?" Baucus wondered aloud on the Senate floor. "How does this create jobs?"

Aided by a sign that blared the phrases "STATES' RIGHTS" and "10TH AMENDMENT," Alexander passionately defended the bill, saying it in no way imposes new taxes or requires states to do anything. Instead, the former Tennessee governor said, the bill simply allows states to decide whether they should collect what's already owed.

A two-term senator, Alexander said he trusts Tennessee's governor and Legislature" over "Washington politicians" to make decisions related to Volunteer State commerce.

Campaigning for re-election in 2014, Alexander has an unusual ally: President Obama.

"We believe that the Marketplace Fairness Act will level the playing field for local small business retailers who are undercut every day by out-of state online companies," White House Press Secretary Jay Carney said Monday.

The five remaining Republican senators from Tennessee, Georgia and Alabama joined Alexander and Monday's majority in voting to begin debate on the bill.