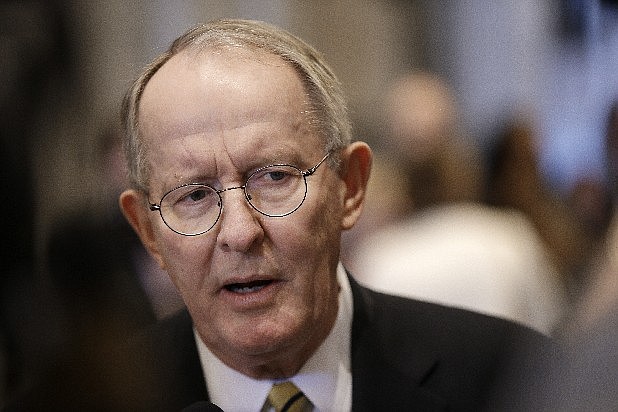

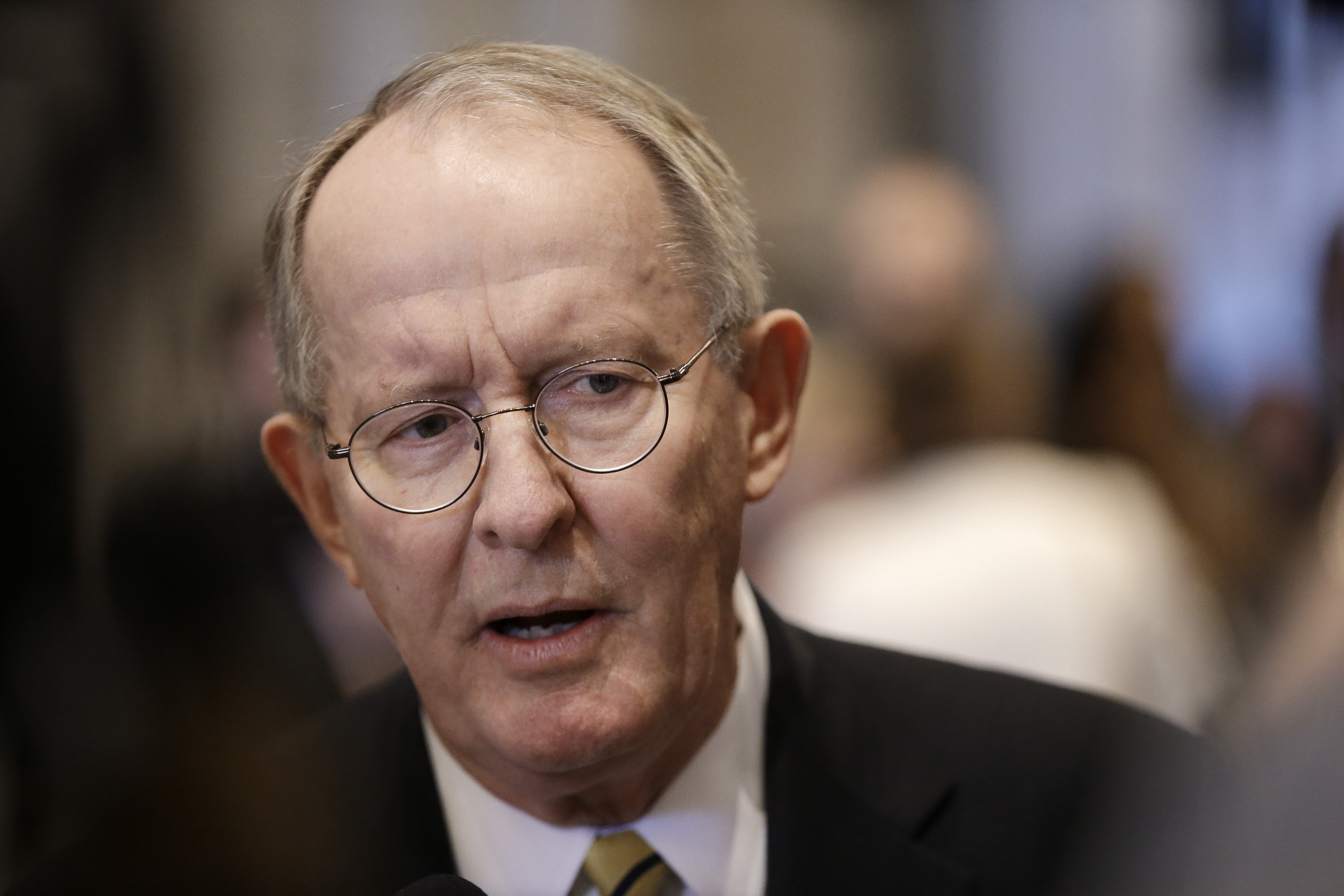

NASHVILLE - U.S. Sen. Lamar Alexander, R-Tenn., says he is cosponsoring two bills that would create a permanent federal income tax deduction for state and local sales taxes paid by residents of Tennessee and other states which have no general state income tax.

The move comes after Congress allowed a temporary deduction for states like Tennessee, Nevada and Washington state expire on Dec. 31 as part of Congress' budget accord. The deduction, first allowed in 2004, had to be renewed every two years. It was among 50 such deductions allowed to lapse in the deal.

"This is a matter of fairness," Alexander said in a news release. "Tennesseans shouldn't pay a greater share of taxes than other taxpayers, simply because we pay sales tax instead of income tax."

One of the bills Alexander is cosponsoring was introduced by Sen. Dean Heller, R-Nev. Sen. Maria Cantwell, D-Wash., introduced the other.

"Making this deduction permanent will provide certainty to Tennesseans who itemize their taxes and allow them to plan their family budgets," Alexander said.

The federal tax code has permanent provisions allowing for the deduction of state income tax from federal income tax payments.

According to Alexander's office, more than 556,000 Tennessee filers in 2011 claimed the deduction for state and local sales tax and reduced their taxable income by some $1.23 billion.

Tennessee does have a limited income tax, known as the Hall Income Tax. It is imposed only on individuals and other entities receiving interest from bonds and notes as well as dividends from stock. The tax does not apply to salaries.