A former employee of the company that manages the Chattanooga Housing Authority's Oaks at Camden and Villages at Alton Park developments claims residents may have been overcharged as much as $170,000 in rent.

The accusation comes in a lawsuit filed in July by former Pennrose property manager Julie G. Bucholtz.

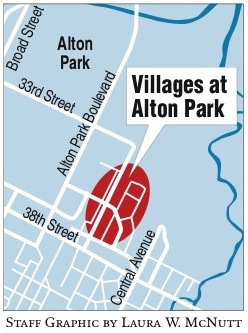

In the suit, Bucholtz accuses Pennrose of firing her because she reported the alleged overcharges to the U.S. Department of Housing and Urban Development and CHA. HUD told the housing authority to complete a "100 percent" audit, including rental recalculations, for all public housing tenants who live in the Villages at Alton Park and the Oaks at Camden, CHA's two mixed-finance developments that are privately managed.

"At HUD's direction, Chattanooga Housing Authority is working with Pennrose to correct the rental overpayments made by the public housing residents at Chattanooga Housing Authority's mixed finance and Hope VI sites," according to a written response by Gloria Shanahan, Southeast regional spokeswoman for the U.S. Department of Housing and Urban Development. "We expect to verify in a couple of months that the overpayment of tenant rents has been corrected."

Both current and former residents at the Pennrose managed properties should be eligible for refunds if they were overcharged for their rents, HUD officials said.

CHA officials say they already have begun the audit, but don't know when it will be complete.

James M. Johnson, Bucholtz's attorney, said he has no complaint filed against CHA, only Pennrose.

Shirley Collins, president of the Villages at Alton Park Resident Association, said she has seen her rent fluctuate from month to month even though her income -- which determines the amount of rent she pays -- has remained the same.

"One month I paid $175, then I paid $151, now it's $166. Which one is it?" she asked.

"Everybody is confused about their rent and, when you go in there (to the housing office) they don't want to talk with you about it," Collins said.

Collins said several residents had rent changes in July after Pennrose switched from allowing residents to pay with money orders to only accepting moneygrams. And if residents had been overcharged for rent, they were given credit for future rent payments instead of a cash refund, she said.

Arlene Tuschl, vice president at the Philadelphia-based Pennrose Management Co., said that the complaint is a human resources issue and she could not comment on it.

It's official #42 #WPS pic.twitter.com/c9PtIF2oud

— Kendrick Jackson (@15Kjackson) April 29, 2015According to Bucholtz's complaint, the overcharge is a result of "not reimbursing excess utility allowances to tenants."

Pennrose receives money for utility allowances from HUD, which sends the money to Pennrose in the tenant's name. Pennrose uses a formula to calculate the rent and, if the utility allowance is more than the calculated rent, the company must pay the difference to the tenant, HUD officials said.

She said she also found records showing that the same type of rent calculations happened in 2008, but were corrected while Carol Newton, now district manager at Pennrose Management, was property manager. But the "illegal practices had later resumed again" under Newton's watch, according to the complaint.

Newton fired Bucholtz on Nov. 3, 2010, the same day Newton returned from a meeting with the CHA official that Bucholtz had told about the alleged overcharging, according to the complaint.

Bucholtz had worked for Pennrose since February 2010.

Newton could not be reached for comment.

Pennrose must respond to the lawsuit within 30 days of July 18, the date the company was served with the suit, according to the court records.